Toyota 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

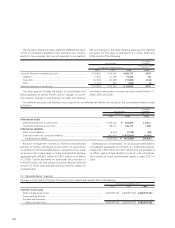

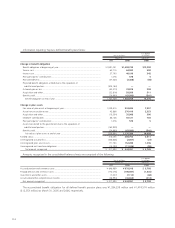

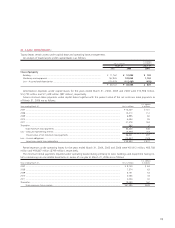

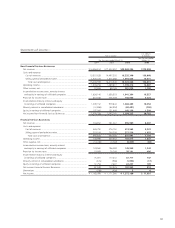

The estimated fair values of Toyota’s financial instruments, excluding marketable securities and other securities investments

and affiliated companies, are summarized as follows:

Yen in millions

March 31, 2005

Carrying Estimated

amount fair value

Asset (Liability)

Cash and cash equivalents ............................................................................................................ ¥ 1,483,753 ¥ 1,483,753

Time deposits ............................................................................................................................... 63,609 63,609

Total finance receivables, net ........................................................................................................ 6,243,359 6,234,855

Other receivables .......................................................................................................................... 355,381 355,381

Short-term borrowings ................................................................................................................. (2,381,827) (2,381,827)

Long-term debt including the current portion ............................................................................... (6,094,565) (6,140,043)

Foreign exchange forward contracts ............................................................................................. (10,176) (10,176)

Interest rate and currency swap agreements ................................................................................. 148,119 148,119

Option contracts purchased.......................................................................................................... 2,282 2,282

Option contracts written............................................................................................................... (4,042) (4,042)

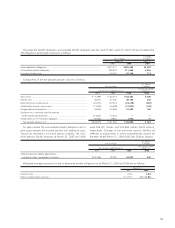

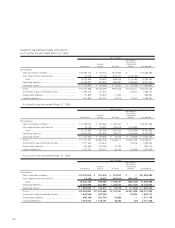

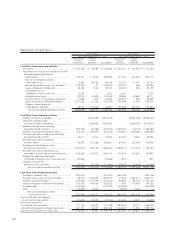

Yen in millions U.S. dollars in millions

March 31, 2006 March 31, 2006

Carrying Estimated Carrying Estimated

amount fair value amount fair value

Asset (Liability)

Cash and cash equivalents ..................................................................... ¥ 1,569,387 ¥ 1,569,387 $ 13,360 $ 13,360

Time deposits ........................................................................................ 50,349 50,349 428 428

Total finance receivables, net ................................................................. 7,601,838 7,413,229 64,713 63,107

Other receivables ................................................................................... 416,336 416,336 3,544 3,544

Short-term borrowings .......................................................................... (3,033,019) (3,033,019) (25,820) (25,820)

Long-term debt including the current portion ........................................ (7,306,037) (7,297,826) (62,195) (62,125)

Foreign exchange forward contracts....................................................... (8,136) (8,136) (69) (69)

Interest rate and currency swap agreements........................................... 101,890 101,890 867 867

Option contracts purchased ................................................................... 2,994 2,994 25 25

Option contracts written........................................................................ (3,035) (3,035) (26) (26)

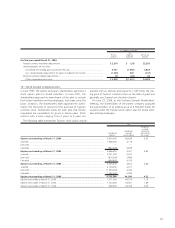

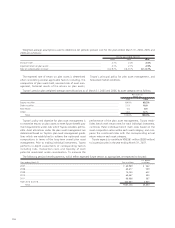

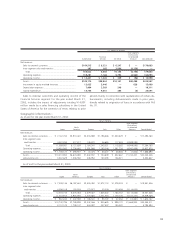

Following are explanatory notes regarding the financial

assets and liabilities other than derivative financial instru-

ments.

Cash and cash equivalents, time deposits and other

receivables—

In the normal course of business, substantially all cash and

cash equivalents, time deposits and other receivables are

highly liquid and are carried at amounts which approximate

fair value.

Finance receivables, net—

The carrying value of variable rate finance receivables was

assumed to approximate fair value as they were repriced at

prevailing market rates at March 31, 2005 and 2006. The fair

value of fixed rate finance receivables was estimated by dis-

counting expected cash flows using the rates at which loans

of similar credit quality and maturity would be made as of

March 31, 2005 and 2006.

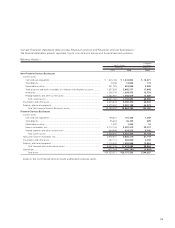

Short-term borrowings and long-term debt—

The fair values of short-term borrowings and total long-term

debt including the current portion were estimated based on

the discounted amounts of future cash flows using Toyota’s

current incremental borrowing rates for similar liabilities.