Toyota 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Toyota will develop operations decisively, setting its sights on

raising market presence and earnings in Europe’s fiercely competi-

tive market.

Market Conditions

Amid intense competition, market

size same as in previous year

In fiscal 2006, sales in the European

automotive market amounted to

17.12 million vehicles, roughly the

same level as in the previous year.

While global automakers compete

fiercely to grow sales and profits,

market size will likely remain in the

region of 17 million vehicles.

Performance Overview

Eighth straight sales record takes

market share above 5% for first time

In Europe in fiscal 2006, Toyota

posted its highest-ever sales for the

eighth year running, with consolidat-

ed shipments of 1.02 million vehi-

cles. As a result, market share on a

calendar-year basis passed 5% for

the first time, and Toyota rose from

eighth to seventh place in Europe’s

passenger car market. On the back

of favorable sales, consolidated pro-

duction totaled 623,000 vehicles.

The Toyota brand enjoyed strong

sales across the European lineup,

including the Yaris, our flagship

mass production model; such main-

stay models as the Corolla and

Avensis; and the Aygo, a small pas-

senger car built by our joint ven-

ture company in the Czech Republic.

Further, efforts to bolster diesel

vehicle sales bore fruit, with diesel

vehicles accounting for 40% of

Toyota’s vehicle sales in 2005, up

from 37% in the previous year.

Mindful of the European market’s

intensifying competition, the Com-

pany will enhance its brand image by

Business Overview

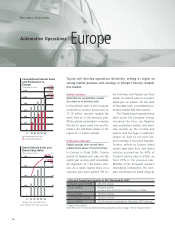

Lift Local Production Capacity to 825 Thousand by 2007

United Kingdom (TMUK) 285,000 vehicles

France (TMMF) 270,000 vehicles

(increase from 240,000 to 270,000 units in 2006)

Turkey (TMMT) 150,000 vehicles

Czech Republic (TPCA) 100,000 vehicles*

Russia (TMMR) 20,000 vehicles (scheduled for December 2007 start-up)

* Toyota-brand vehicles

Note: Please see the Overseas Manufacturing Companies section on page 134 for full plant names.

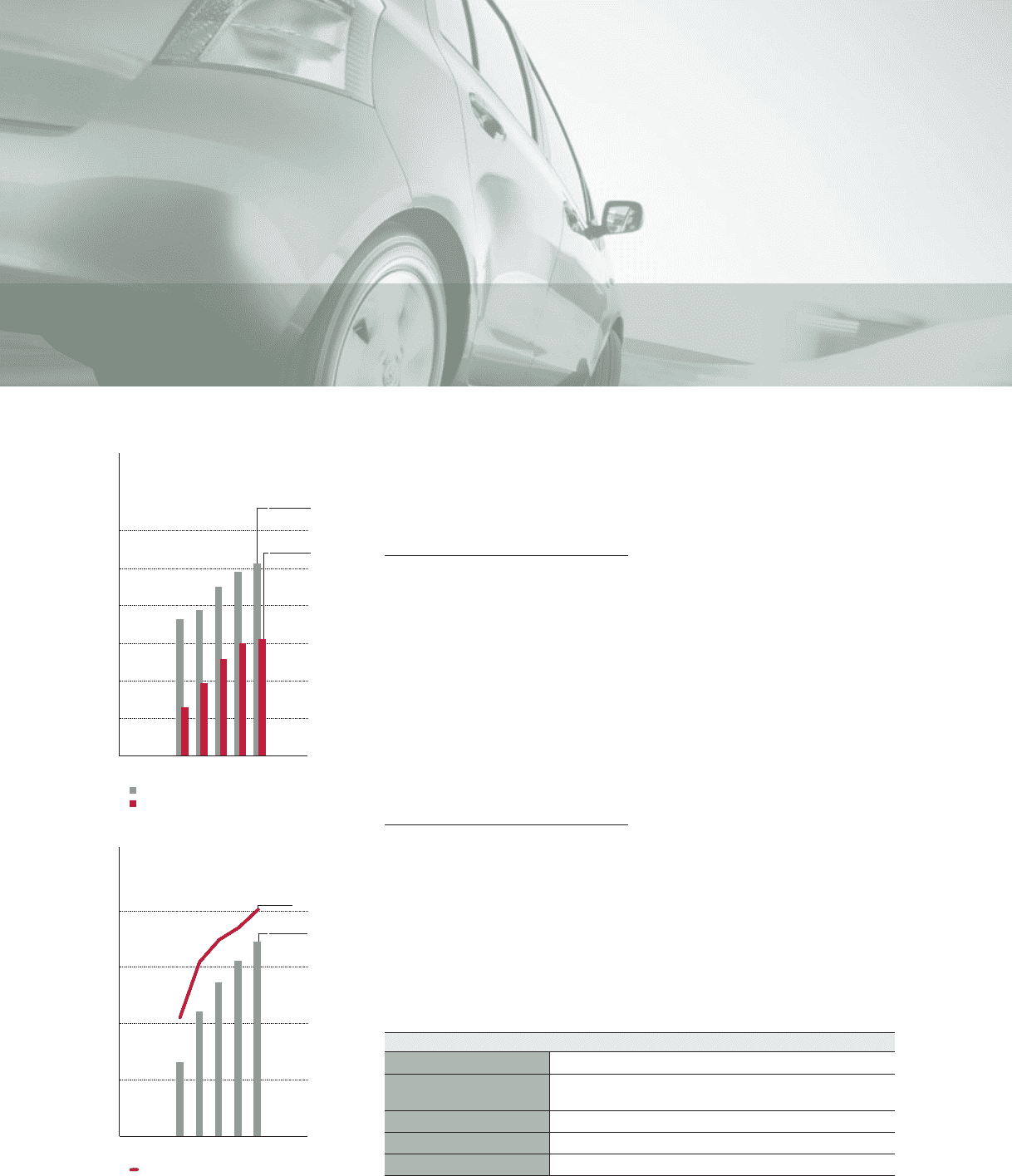

400

200

1,000

600

800

1,200

’02 ’03 ’04 ’05 ’06

FY

Consolidated Vehicle Sales

and Production in

Europe

(Thousands of units)

Consolidated vehicle sales

Consolidated production

0

+4.5%

+4.5%

1,023

623

100

300

200

400

10

30

20

40

’01 ’02 ’03 ’04 ’05

CY

Diesel Vehicle Sales and

Diesel Sales Ratio

(Thousands of units) (%)

Diesel sales ratio (Right scale)

Note: Different from fiscal year figures

00

40.3%

+10.6%

345

Automotive Operations Europe