Toyota 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

In June 2001, the CDBPPL was enacted and allowed any EPF

to terminate its operation relating to the Substitutional

Portion that in the past an EPF had operated and managed in

lieu of the government, subject to approval from the Japanese

Minister of Health, Labour and Welfare. In September 2003,

Toyota Motor Pension Fund, the parent company’s EPF under

JWPIL, obtained the approval from the Minister for the exemp-

tion from benefit payments related to employee services of the

Substitutional Portion. In January 2004, Toyota Motor Pension

Fund completed the transfer of the plan assets attributable to

the Substitutional Portion to the government. In addition,

during the years ended March 31, 2004 and 2005, sub-

sidiaries in Japan that had EPFs under JWPIL also completed

the transfer of the plan assets attributable to the

Substitutional Portion in compliance with the same proce-

dures followed by the parent company.

In accordance with the consensus on EITF Issue No. 03-2,

Accounting for the Transfer to the Japanese Government of

the Substitutional Portion of Employee Pension Fund Liabilities

(“EITF 03-2”), Toyota accounted the entire separation process,

upon completion of transfer of the plan assets attributable to

the Substitutional Portion to the government, as a single set-

tlement transaction. During the years ended March 31, 2004

and 2005, Toyota recognized settlement losses of ¥323,715

million and ¥96,066 million, respectively, as part of net peri-

odic pension costs which are the proportionate amounts of

the net unrecognized losses immediately prior to the separa-

tion related to the entire EPFs under JWPIL, and which are

determined based on the proportion of the projected benefit

obligation settled to the total projected benefit obligation

immediately prior to the separation. Toyota also recognized as

reductions of net periodic pension costs totaling ¥109,885

million and ¥21,722 million for the years ended March 31,

2004 and 2005, respectively, which resulted in gains attrib-

uted to the derecognition of previously accrued salary pro-

gression. In addition, Toyota recognized gains of ¥320,867

million and ¥121,553 million for the years ended March 31,

2004 and 2005, respectively, which represented the differ-

ences between the obligation settled and the assets trans-

ferred to the government. These gains and losses are reflected

in the consolidated statement of income for the years ended

March 31, 2004 and 2005 as follows:

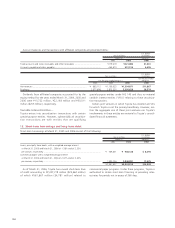

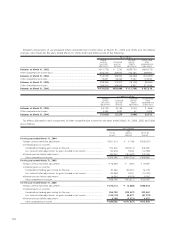

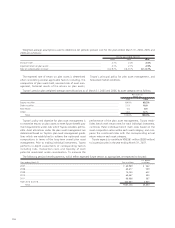

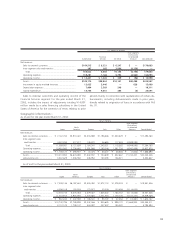

Yen in millions

For the year ended March 31, 2004

Costs of Selling, general

products sold and administrative Total

Settlement losses ................................................................................................................ ¥(288,177) ¥ (35,538) ¥(323,715)

Gains on derecognition of previously accrued salary progression.......................................... 98,079 11,806 109,885

Gains on difference between the obligation settled and the assets transferred ..................... — 320,867 320,867

Total........................................................................................................................... ¥(190,098) ¥297,135 ¥ 107,037

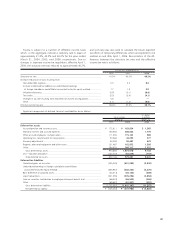

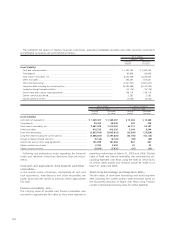

Yen in millions

For the year ended March 31, 2005

Costs of Selling, general

products sold and administrative Total

Settlement losses ................................................................................................................ ¥(85,379) ¥ (10,687) ¥ (96,066)

Gains on derecognition of previously accrued salary progression.......................................... 19,494 2,228 21,722

Gains on difference between the obligation settled and the assets transferred ..................... — 121,553 121,553

Total........................................................................................................................... ¥(65,885) ¥113,094 ¥ 47,209

All these gains and losses are non-cash gains and losses,

and reported on a net basis in “Pension and severance costs,

less payments” in the consolidated statements of cash flows

for the years ended March 31, 2004 and 2005.

During the year ended March 31, 2006, no gains or losses

relating to the transfer to the government of the

Substitutional Portion of the EPF liabilities.

Toyota uses a March 31 measurement date for the majority

of its benefit plans.