Toyota 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

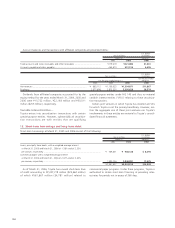

Expected cumulative static pool losses over the life of the

securitizations are calculated by taking actual life to date

losses plus projected losses and dividing the sum by the origi-

nal balance of each pool of assets. Expected cumulative static

pool credit losses for the retail loans securitized for the years

ended March 31, 2004, 2005 and 2006 were 0.41%, 0.40%

and 0.19%, respectively.

Toyota sold finance receivables under the program and rec-

ognized pretax gains resulting from these sales of ¥5,608 mil-

lion, ¥323 million and ¥837 million ($7 million) for the years

ended March 31, 2004, 2005 and 2006, respectively, after

providing an allowance for estimated credit losses. The gain

on sale recorded depends on the carrying amount of the

assets at the time of the sale. The carrying amount is allocated

between the assets sold and the retained interests based on

their relative fair values at the date of the sale. The key eco-

nomic assumptions initially and subsequently measuring the

fair value of retained interests include the market interest rate

environment, severity and rate of credit losses, and the

prepayment speed of the receivables. All key economic

assumptions used in the valuation of the retained interests are

reviewed periodically and are revised as considered necessary.

At March 31, 2005 and 2006, Toyota’s retained interests

relating to these securitizations include interest in trusts, inter-

est-only strips, and other receivables, amounting to ¥18,896

million and ¥18,316 million ($156 million), respectively.

Toyota recorded no impairments on retained interests for

the years ended March 31, 2004, 2005 and 2006. Those

impairments were calculated, if any, by discounting cash flows

using management’s estimates and other key economic

assumptions.

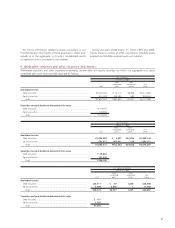

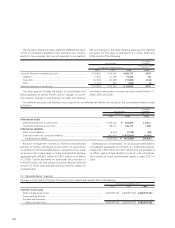

Key economic assumptions used in measuring the fair value of retained interests at the sale date of securitization transactions

completed during the years ended March 31, 2004, 2005 and 2006 were as follows:

For the years ended March 31,

2004 2005 2006

Prepayment speed related to securitizations .............................................................................. 1.0%–1.5% 0.7%–1.1% 0.7%–1.4%

Weighted-average life (in years) ................................................................................................1.70–1.85 1.85 1.72–2.06

Expected annual credit losses.................................................................................................... 0.50%–0.80% 0.30% 0.05%–0.18%

Discount rate used on the subordinated securities..................................................................... 5.0% — —

Discount rate used on other retained interests .......................................................................... 8.0%–15.0% 15.0% 5.0%

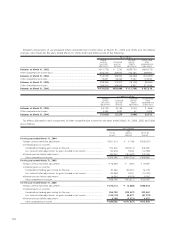

The following table summarizes certain cash flows received from and paid to the securitization trusts for the years ended

March 31, 2004, 2005 and 2006.

U.S. dollars

Yen in millions in millions

For the year ended

For the years ended March 31, March 31,

2004 2005 2006 2006

Proceeds from new securitizations, net of purchased

and retained securities......................................................................... ¥168,135 ¥ 48,958 ¥ 88,698 $755

Servicing fees received ........................................................................... 6,860 3,762 2,297 20

Excess interest received from interest only strips..................................... 20,514 9,140 4,219 36

Repurchases of receivables..................................................................... (33,614) (34,675) (50,086) (426)

Servicing advances................................................................................. (792) (215) (453) (4)

Reimbursement of servicing and maturity advances................................ 1,358 860 793 7