Toyota 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

In calendar 2004 and 2005, Toyota produced 62.9% and

62.0% of Toyota’s non-domestic sales outside Japan, respectively.

In North America, 63.7% and 61.1% of vehicles sold in calendar

2004 and 2005 were produced locally, respectively. In Europe,

56.7% and 59.6% of vehicles sold in calendar 2004 and 2005

were produced locally, respectively. Localizing production

enables Toyota to purchase many of the supplies and resources

used in the production process, which allows for a better match

of local currency revenues with local currency expenses.

Toyota also enters into foreign currency transactions and

other hedging instruments to address a portion of its transac-

tion risk. This has reduced, but not eliminated, the effects of

foreign currency exchange rate fluctuations, which in some

years can be significant. See notes 20 and 21 to the consolidat-

ed financial statements for additional information regarding the

extent of Toyota’s use of derivative financial instruments to

hedge foreign currency exchange rate risks.

Generally, a weakening of the Japanese yen against other

currencies has a positive effect on Toyota’s revenues, operating

income and net income. A strengthening of the Japanese yen

against other currencies has the opposite effect. The Japanese

yen has on average been stronger against the U.S. dollar during

fiscal 2005 and weaker against the U.S. dollar during fiscal

2006. At the end of fiscal 2005 and 2006, the Japanese yen

was weaker against the U.S. dollar in comparison to the end of

the prior fiscal year. As compared to the euro, the Japanese yen

has on average been weaker during fiscal 2005 and 2006. At

the end of fiscal 2005 and 2006, the Japanese yen was weaker

against the euro compared to the end of the prior fiscal year.

See further discussion in the Market Risk Disclosures section

regarding “Foreign Currency Exchange Rate Risk”.

During fiscal 2005 and 2006, the average value of the yen

fluctuated against the major currencies including the U.S. dollar

and euro compared with the average value of the previous fiscal

year, respectively, as noted above. The operating results exclud-

ing the impact of currency fluctuations described in the “Results

of Operations—Fiscal 2006 Compared with Fiscal 2005” and

the “Results of Operations—Fiscal 2005 Compared with Fiscal

2004” show results of net revenues obtained by applying the

yen’s average exchange rate in the previous fiscal year to the

local currency-denominated net revenues for fiscal 2005 and

2006, respectively, as if the value of the yen had remained con-

stant for the comparable periods. Results excluding the impact

of currency fluctuations year-on-year are not on the same basis

as Toyota’s consolidated financial statements and do not con-

form with U.S. GAAP. Furthermore, Toyota does not believe

that these measures are a substitute for U.S. GAAP measures.

However, Toyota believes that such results excluding the impact

of currency fluctuations year-on-year provide additional useful

information to investors regarding the operating performance

on a local currency basis.

Segmentation

Toyota’s most significant business segment is its automotive

operations. Toyota carries out its automotive operations as a

global competitor in the worldwide automotive market.

Management allocates resources to, and assesses the perform-

ance of, its automotive operations as a single business segment

on a worldwide basis. Toyota does not manage any subset of its

automotive operations, such as domestic or overseas operations

or parts, as separate management units.

The management of the automotive operations is aligned

on a functional basis with managers having oversight responsi-

bility for the major operating functions within the segment.

Management assesses financial and non-financial data such as

units of sale, units of production, market share information,

vehicle model plans and plant location costs to allocate

resources within the automotive operations.

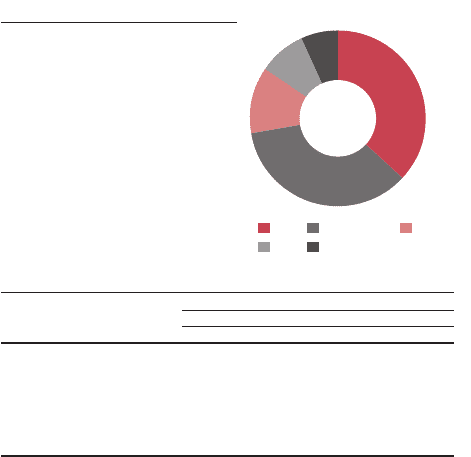

Geographic Breakdown

The following table sets forth

Toyota’s net revenues in each

geographic market based on the

country location of the parent

company or the subsidiary that

transacted the sale with the

external customer for the past

three fiscal years.

Yen in millions

For the year ended March 31,

2004 2005 2006

Japan................................... ¥7,167,704 ¥7,408,136 ¥7,735,109

North America ..................... 5,910,422 6,187,624 7,455,818

Europe................................. 2,018,969 2,305,450 2,574,014

Asia ..................................... 1,196,836 1,572,113 1,836,855

Other ................................... 1,000,829 1,078,203 1,435,113

Japan North America Europe

Asia All Other Markets

Revenues by Market

FY 2006

8.7%

6.8%

12.2%

35.5%

36.8%