Toyota 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

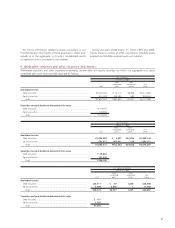

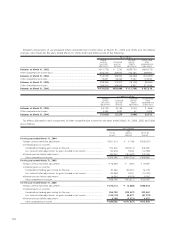

The key economic assumptions and the sensitivity of the current fair value of the retained interest to an immediate 10 and 20

percent adverse change in those economic assumptions are presented below.

U.S. dollars

Yen in millions in millions

March 31, March 31,

2006 2006

Prepayment speed assumption (annual rate) ........................................................................................... 0.7%–1.5%

Impact on fair value of 10% adverse change ....................................................................................... ¥(136) $(1)

Impact on fair value of 20% adverse change ....................................................................................... (271) (2)

Residual cash flows discount rate (annual rate)........................................................................................ 5.0%–12.0%

Impact on fair value of 10% adverse change ....................................................................................... ¥ (172) $(1)

Impact on fair value of 20% adverse change ....................................................................................... (341) (3)

Expected credit losses (annual rate)......................................................................................................... 0.05%–0.41%

Impact on fair value of 10% adverse change ....................................................................................... ¥(56) $(0)

Impact on fair value of 20% adverse change ....................................................................................... (125) (1)

These hypothetical scenarios do not reflect expected market

conditions and should not be used as a prediction of future

performance. As the figures indicate, changes in the fair value

may not be linear. Also, in this table, the effect of a variation

in a particular assumption on the fair value of the retained

interest is calculated without changing any other assumption.

Actual changes in one factor may result in changes in another,

which might magnify or counteract the sensitivities. Actual

cash flows may differ from the above analysis.

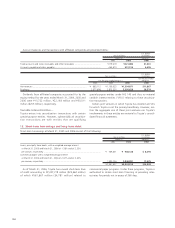

Outstanding receivable balances and delinquency amounts for managed retail and lease receivables, which include both

owned and securitized receivables, as of March 31, 2005 and 2006 are as follows:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2005 2006 2006

Principal amount outstanding.............................................................................................. ¥5,520,484 ¥6,543,496 $55,704

Delinquent amounts over 60 days or more .......................................................................... 23,396 32,799 279

Comprised of:

Receivables owned .......................................................................................................... ¥5,240,276 ¥6,337,306 $53,949

Receivables securitized .................................................................................................... 280,208 206,190 1,755

Credit losses, net of recoveries attributed to managed retail and lease receivables for the years ended March 31, 2004, 2005

and 2006 totaled ¥48,011 million, ¥34,455 million and ¥46,427 million ($395 million), respectively.

Other receivables relate to arrangements with certain component manufacturers whereby Toyota procures inventory for these

component manufacturers and is reimbursed for the related purchases.

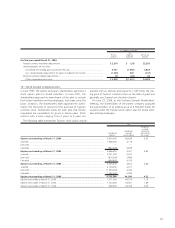

8. Other receivables:

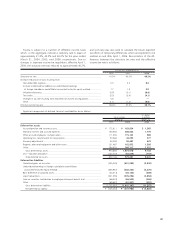

9. Inventories:

Inventories consist of the following:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2005 2006 2006

Finished goods.................................................................................................................... ¥ 890,118 ¥1,097,203 $ 9,340

Raw materials...................................................................................................................... 189,675 221,285 1,884

Work in process .................................................................................................................. 179,943 239,450 2,038

Supplies and other .............................................................................................................. 46,973 63,037 537

¥1,306,709 ¥1,620,975 $13,799