Toyota 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

attributed to the increased vehicle unit sales partially offset by

changes in sales mix, the impact of increased parts and service

sales, and the impact of the increase in research and develop-

ment expenses, which were partially offset by the impact of

continued cost reduction efforts, the impact of the decrease in

the settlement losses relating to the transfer to the government

of the substitutional portion and the impact of fluctuations in

foreign currency translation rates during fiscal 2005. The

increase in cost of products sold for all other operations primari-

ly related to the increase in net revenues.

Cost of financing operations increased by ¥5.7 billion, or

1.6%, to ¥369.8 billion during fiscal 2005 compared with the

prior year. The increase resulted primarily from the impact of

increased interest expenses caused primarily by higher interest

rates and an increase in borrowings attributed to business

expansion in the United States, that was partially offset by the

impact of an increase in net gains on derivative financial instru-

ments that are not designated as hedges and are marked-to-

market at the end of each period and lower provisions for the

allowance for residual value losses due to a decline in the return

rate of leased vehicles.

Selling, general and administrative expenses increased by

¥251.9 billion, or 14.3%, to ¥2,009.2 billion during fiscal 2005

compared with the prior year. This increase (before the elimina-

tion of intersegment amounts) reflects an increase of ¥324.5

billion, or 21.8%, for the automotive operations, a decrease of

¥20.9 billion, or 9.3%, for the financial services operations and

an increase of ¥3.0 billion, or 2.5%, for all other operations seg-

ment. The increase for the automotive operations consisted pri-

marily of the impact from the reduction of gains attributed to

the transfer of the substitutional portion of certain employee

pension funds to the government and the impact of increased

expenses in expanding business operations, which were partially

offset by the impact of fluctuations in foreign currency transla-

tion rates. The decrease for the financial services operations

reflects lower provisions for credit losses specifically in North

America due to an improvement in the delinquent loan collec-

tion rate and the impact of fluctuations in foreign currency

translation rates.

Research and development expenses (included in cost of

products sales and selling, general and administrative expenses)

increased by ¥72.9 billion, or 10.7%, to ¥755.1 billion during

fiscal 2005 compared with the prior year. This increase primarily

relates to expenditures attributed to the development of envi-

ronmentally conscious technologies including hybrid and fuel

cell battery technology, aggressive developments in advanced

technologies relating to collision safety and vehicle stability con-

trols and the impact of expanding new models to promote

Toyota’s strength in a competitive global market to further build

up strength in future.

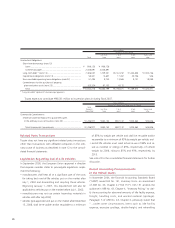

Operating Income

Toyota’s operating income increased by ¥5.3 billion, or 0.3%,

to ¥1,672.1 billion during fiscal 2005 compared with the prior

year. Operating income was favorably affected by the vehicle

unit sales growth partially offset by changes in sales mix, the

impact of increased parts and service sales, continued cost

reduction efforts, growth in the financial services operations

and improvements in all other operations. These increases were

partially offset by a reduction in the net gains on the transfer to

the government of the substitutional portion of certain employ-

ee pension funds, increases in research and development

expenses, the impact of business expansion and the unfavorable

impact of fluctuations in foreign currency translation rates. As a

result, operating income decreased to 9.0% as a percentage of

net revenues for fiscal 2005 compared to 9.6% in the prior year.

During fiscal 2005, operating income (before the elimina-

tion of intersegment profits) by significant geographies resulted

in a decrease of ¥120.9 billion, or 10.9%, in Japan, and increas-

es of ¥56.5 billion, or 14.5%, in North America, ¥36.0 billion,

or 49.8% in Europe, ¥33.5 billion, or 55.6% in Asia and ¥10.8

billion, or 29.5% in Other compared with the prior year. The

decrease in Japan relates primarily to the impact of a decrease

in the net gains relating to the transfer to the government of

the substitutional portion of certain employee funds, increases

in research and development expenses and the unfavorable

impact of fluctuations in foreign currency translation rates. The

decrease was partially offset by the vehicle unit sales growth in

both of the domestic and export markets partially offset by

changes in sales mix and continued cost reduction efforts. The

increase in North America relates primarily to the increase in

production volume and vehicle unit sales, the impact of cost

reduction efforts in the manufacturing operations, increases in

the asset base of the financial services operations, and lower

provisions for credit losses and the allowance for residual value

losses which were partially offset by an increase in expenses