Toyota 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Financial Services Operations

Business Overview

Financing volume and revenues up due

to robust automotive sales

In fiscal 2006, operating income

declined because of such factors as the

valuation losses on interest rate swaps

stated at fair value that offset a large

increase in revenues from financial

services operations associated with

higher financing volume.

Toyota’s financial services opera-

tions play a vital role—underpinning

the growth of the Company’s core

automotive operations. Because car

purchases often require auto loans,

delivering superior quality auto sales

financing is a key part of competitive

marketing. Covering 31 countries and

regions, including Japan, financial ser-

vices operations center on Toyota

Financial Services Corporation (TFS),

which has overall control of financial

services subsidiaries in Japan and

overseas. TFS has constructed a global

network that covers approximately

90% of the markets in which Toyota

sells its vehicles.

At present, TFS provides financial

services related to vehicle purchases

and leases to approximately 6 million

customers worldwide. Further, TFS

has the highest credit rating of U.S.

rating agencies Standard & Poor’s

and Moody’s. Backed by such solid

creditworthiness, TFS provides ser-

vices customers trust.

Business Strategy

Offer one-stop financial services

centered on auto sales

In addition to auto sales financing,

the TFS Group is focusing on offering

comprehensive financial services that

closely reflect customers’ lifestyle

needs. Particularly in Japan, the group

provides wide-ranging financial ser-

vices that include auto sales financ-

ing, retail sales of corporate bonds

and investment trusts, asset develop-

ment services for individuals, housing

loans, and insurance. For example,

Toyota Financial Services Securities

Corporation offers Toyota Group cor-

porate bonds and securities with high

credit ratings denominated in foreign

currencies, mainly those issued by the

World Bank (International Bank for

Reconstruction and Development)

and other institutions.

In addition, Toyota Finance Corpora-

tion released the TS CUBIC CARD in

2001, aiming to create a more acces-

sible and convenient credit card by

incorporating functions and services

not normally available from credit

cards. The TS CUBIC CARD had approx-

imately 5.4 million cardholders at fis-

cal year-end. Also, Toyota Finance

Corporation has the largest joint ETC

(electronic toll collection) member-

ship—1.7 million cardholders at fiscal

year-end—in the domestic ETC card

industry.

Business Overview

3,000

9,000

6,000

12,000

’02 ’03 ’04 ’05 ’06

FY

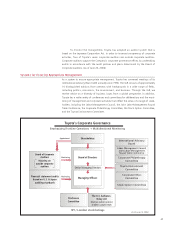

Total Assets by Financial

Services Operations

(¥ Billion)

0

Overview of Toyota’s Financial Services

Operations FY 2006

Total financial services

segment assets........... ¥11,613.5 billion

Revenues from financial

services operations ........ ¥996.9 billion

Operating income ......... ¥155.8 billion

Credit ratings .............. AAA /Aaa

Operating areas .......... 31 countries and

regions worldwide

Market coverage .......... approx. 90%

No. of customers.......... approx. 11 million

No. of employees ......... approx. 8,000

Financial Services Operations Organization

100

%

33.4

%

100% 100% 50% 50% 100%

Toyota Accounting

Service Co.

Overseas Sales

Finance Companies

Toyota Finance

Corporation

Toyota Financial Services

Securities Corporation

Toyota Financial

Services Corporation

Toyota Motor

Corporation

Toyota Asset

Management Co., Ltd.

Aioi Insurance

Co., Ltd.

Our global auto sales financing network encompassing 31 countries and regions provides high-quality

financial services to customers seeking to purchase Toyota vehicles.