TCF Bank 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

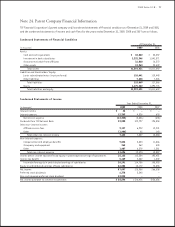

78 : TCF Financial Corporation and Subsidiaries

TCF Financial Corporation’s (parent company only)

operations are conducted through its banking subsidiaries

and other subsidiaries. As a result, TCF’s cash ow and abil-

ity to make dividend payments to its common stockholders

depend on the earnings of its subsidiaries. The ability of

TCF’s banking subsidiaries to pay dividends or make other

payments to TCF is limited by their obligations to maintain

sufcient capital and by other regulatory restrictions on

dividends. At December 31, 2009, TCF’s banking subsidiar-

ies could pay a total of approximately $158.3 million in

dividends to TCF without prior regulatory approval.

Additionally, retained earnings at TCF National Bank,

a wholly owned subsidiary of TCF Financial Corporation, at

December 31, 2009 includes approximately $134.4 million

for which no provision for federal income taxes has been

made. This amount represents earnings legally appropri-

ated to thrift bad debt reserves and deducted for federal

income tax purposes in prior years and is generally not

available for payment of cash dividends or other distribu-

tions to shareholders. Future payments or distributions of

these appropriated earnings could invoke a tax liability for

TCF based on the amount of the distributions and the tax

rates in effect at that time.

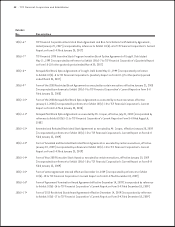

Note 25. Litigation Contingencies

From time to time, TCF is a party to legal proceedings arising

out of its lending, leasing and deposit operations. TCF is

and expects to become engaged in a number of foreclosure

proceedings and other collection actions as part of its

lending and leasing collection activities. From time to time,

borrowers and other customers, or employees or former

employees, have also brought actions against TCF, in some

cases claiming substantial damages. Financial services

companies are subject to the risk of class action litigation,

and TCF has had such actions brought against it from time

to time. Litigation is often unpredictable and the actual

results of litigation cannot be determined with certainty.

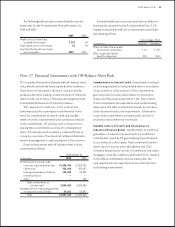

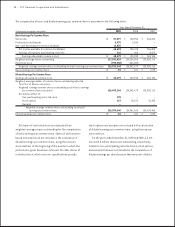

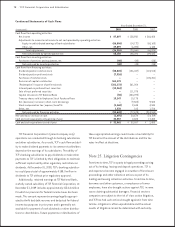

Year Ended December 31,

(In thousands) 2008 2007

Cash ows from operating activities:

Net income $ 128,958 $ 266,808

Adjustments to reconcile net income to net cash provided by operating activities:

Equity in undistributed earnings of bank subsidiaries (14,172) (68,163)

Other, net (6,394) 1,188

Total adjustments (20,566) (66,975)

Net cash provided by operating activities 108,392 199,833

Cash ows from investing activities:

Purchases of premises and equipment, net (40) (88)

Net cash used by investing activities (40) (88)

Cash ows from nancing activities:

Dividends paid on common stock (126,447) (124,513)

Dividends paid on preferred stock – –

Purchases of common stock – (105,251)

Recission of capital contribution – –

(Redemption)/Issuance of preferred stock 361,004 –

Interest paid on preferred trust securities – –

Sale of trust preferred securities 111,378 –

Capital infusions to TCF National Bank (434,092) –

Treasury shares sold to Employees Stock Purchase Plans 10,178 –

Net (decrease) increase in short-term borrowings (9,500) 9,500

Stock compensation tax (expense) benets 9,638 4,534

Other, net 163 1,216

Net cash used by nancing activities (77,678) (214,514)

Net (decrease) increase in cash 30,674 (14,769)

Cash and cash equivalents at beginning of year 2,883 17,652

Cash and cash equivalents at end of year $ 33,557 $ 2,883