TCF Bank 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 : TCF Financial Corporation and Subsidiaries

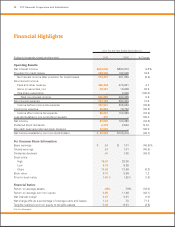

• TCF’s net interest margin was 3.87 percent for the full

year of 2009 and 4.07 percent in the fourth quarter of

2009. Our industry leading deposit strategies and the

reduction of high interest-rate certificates of deposit

balances in 2009 contributed significantly to net interest

margin. In addition, we continued to closely monitor

pricing on both our deposits and loans and leases in order

to stay competitive and yield the highest return. TCF’s net

interest margin continues to be better than the average

of the Top 50 Banks by approximately 66 basis points.

• To preserve capital in today’s market, TCF lowered

its annual dividend rate to $.20 per share in 2009. The

dividend reduction accelerates the accumulation of

retained earnings. In addition, it adds to our capital base

for future growth. Prudent capital management allowed

us to take advantage of growth opportunities to expand

our business without diluting our stockholder base. TCF

has paid dividends 87 consecutive quarters and returning

capital to our stockholders is an important part of how we

deliver value.

• TCF is financially strong and remains a safe and sound

bank. We are solidly capitalized and have ample liquidity

to conduct business. TCF’s Tier 1 risk-based capital was

$1.2 billion, or 8.52 percent of risk-weighted assets, and

total risk-based capital was $1.5 billion, or 11.12 percent

of risk-weighted assets. We continue to exceed

the well-capitalized requirements as defined by the

Federal Reserve Board. At December 31, 2009, TCF

had $152.1 million of excess total risk-based capital over

the stated well-capitalized requirement. TCF’s tangible

common equity ratio was 5.86 percent. TCF has access

to the capital markets to raise additional equity or debt

for future expansion.

• TCF reorganized its day-to-day operations by business

lines: Retail Banking (branch banking and retail lending),

Wholesale Banking (commercial banking, leasing and

equipment finance, and inventory finance), Treasury

Services and Support Services. Each business line has

its own profit center goals and objectives. We believe

the new organizational structure improves our already

highly responsive and performance-driven culture.

TCF Retail Banking:

TCF’s average core deposits, which include checking,

savings and money market deposits, totaled a record

$7.2 billion at December 31, 2009, up 37 percent from

last year. TCF does not have any brokered deposits.

Savings was our largest deposit growth category in 2009,

increasing 68 percent as a result of several initiatives on

product features, pricing, cross-selling and marketing that

were incorporated into our sales program. In addition, we

continued to aggressively market our checking account

products resulting in an astonishing 24 percent increase

in the number of new checking accounts opened in

2009. Our Free Cash premium and Tell-A-Friend campaign

were highly successful in attracting new customers to

TCF, thus allowing for additional cross-sell opportunities

and future fee income. Another key part of our deposit

strategy in 2009 was the designed runoff of high interest-

rate certificates of deposits, which reduced our cost

of funds and improved our net interest margin. We

will continue to focus our efforts on growing low-cost

deposits in 2010 and looking for new products and

premiums to introduce into the market.

In 2010, we will once again keep our organic branch

expansion plans to a minimum unless opportunities arise

with our two supermarket partners. We will continue to

evaluate positively accretive acquisition transactions or an

0908070605

$2.09

$1.01

$.54

Diluted Earnings

Per Common Share

Dollars

Diluted EPS

Dividends Paid

$1.97

$1.86

0908070605

$1,246

Risk-Based Capital

Millions of Dollars

TARP

Total Risk-Based Capital

Well Capitalized Requirement

$1,050

$1,173

$1,515

$1,817