TCF Bank 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

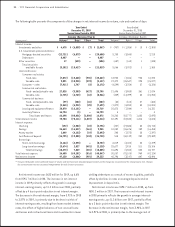

18 : TCF Financial Corporation and Subsidiaries

TCF’s lending strategy is to originate high credit quality,

primarily secured, loans and leases. TCF’s largest core

lending business is its consumer real estate loan operation,

which offers xed- and variable-rate loans and lines of

credit secured by residential real estate properties.

Commercial loans are generally made on local properties

or to local customers. The leasing and equipment nance

businesses consist of TCF Equipment Finance, a company

that delivers equipment nance solutions to businesses in

select markets, and Winthrop Resources, a company that

primarily leases technology and data processing equipment.

TCF’s leasing and equipment nance businesses have

equipment installations in all 50 states and, to a limited

extent, in foreign countries. In December 2008, TCF Inventory

Finance commenced lending operations to provide inventory

nancing to businesses in the United States and Canada.

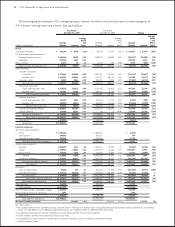

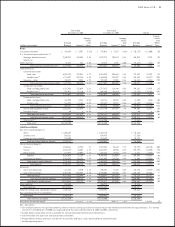

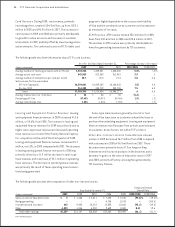

Net interest income, the difference between interest

income earned on loans and leases, securities available

for sale, investments and other interest-earning assets

and interest paid on deposits and borrowings, represented

54.6% of TCF’s total revenue in 2009. Net interest income can

change signicantly from period to period based on general

levels of interest rates, customer prepayment patterns,

the mix of interest-earning assets and the mix of interest-

bearing and non-interest bearing deposits and borrowings.

TCF manages the risk of changes in interest rates on its net

interest income through an Asset/Liability Management

Committee and through related interest-rate risk monitor-

ing and management policies. See “Item 1A. Risk Factors”

and “Item 7A. Quantitative and Qualitative Disclosures

about Market Risk” for further discussion.

Non-interest income is a signicant source of revenue

for TCF and an important factor in TCF’s results of opera-

tions. Increasing fee and service charge revenue has been

challenging as a result of changing customer behavior.

Providing a wide range of retail banking services is an

integral component of TCF’s business philosophy and a

major strategy for generating additional non-interest

income. Key drivers of non-interest income are the number

of deposit accounts and related transaction activity. The

Federal Reserve issued a new regulation in November of

2009 that restricts the imposition of overdraft fees which

could have a signicant adverse impact on TCF’s non-inter-

est income. Starting on July 1, 2010, TCF will have to ask

their customers to opt in before TCF can assess fees for

ATM and debit card overdraft transactions.

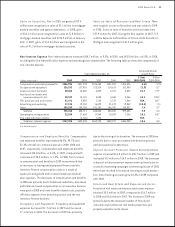

Recent legislative proposals would, if enacted, further

restrict or limit TCF’s ability to impose overdraft fees on

retail checking accounts and interchange fees on debit card

transactions and could have a signicant adverse impact

on TCF’s non-interest income.

In response to these new regulations, TCF recently

introduced a new anchor checking account product that

will replace the TCF Totally Free Checking product. The new

product will carry a monthly maintenance fee on accounts not

meeting certain specic requirements. See “Management’s

Discussion and Analysis of Financial Condition and Results

of Operations — Consolidated Income Statement Analysis

— Non-Interest Income” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations

— Forward-Looking Information” for additional information.

The Company’s Visa debit card program has grown

signicantly since its inception in 1996. TCF is the 10th

largest issuer of Visa Classic debit cards in the United

States, based on sales volume for the three months ended

September 30, 2009, as published by Visa. TCF earns

interchange revenue from customer card transactions paid

primarily by merchants, not TCF’s customers. Card products

represent 23.3% of banking fee revenue for the year ended

December 31, 2009, and change based on customer pay-

ment trends and the number of deposit accounts using the

cards. Visa has signicant litigation against it regarding

interchange pricing and there is a risk this revenue could

be impacted by any settlement or adverse rulings in such

litigation. See “Item 1A. Risk Factors — Card Revenue” for

further discussion.

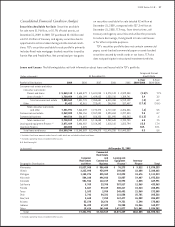

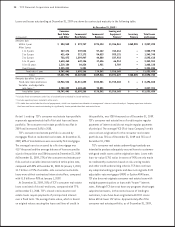

The following portions of Management’s Discussion and

Analysis of Financial Condition and Results of Operations

focus in more detail on the results of operations for 2009,

2008 and 2007 and on information about TCF’s balance

sheet, credit quality, liquidity, funding resources, capital

and other matters.

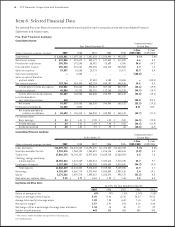

Results of Operations

TCF reported diluted earnings

per common share of $.54 for 2009, compared with $1.01

for 2008 and $2.09 for 2007. Net income was $87.1 million

for 2009, compared with $129 million for 2008 and $266.8