TCF Bank 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Form 10-K : 25

Gains on Securities, Net In 2009, net gains of $29.4

million were recognized on sales of $2.1 billion in mortgage-

backed securities and agency debentures. In 2008, gains

of $16.1 million were recognized on sales of $1.5 billion in

mortgage-backed securities and $174.9 million in treasury

bills. In 2007, gains of $13.3 million were recognized on the

sales of $1.2 billion in mortgage-backed securities.

Gains on Sales of Branches and Real Estate There

were no gains on sales of branches and real estate in 2009

or 2008. Gains on sales of branches and real estate were

$37.9 million for 2007. During the rst quarter of 2007, TCF

sold the deposits and facilities of 10 out-state branches in

Michigan and recognized a $31.2 million gain.

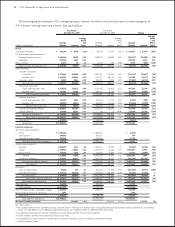

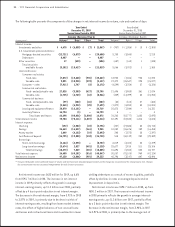

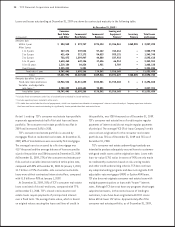

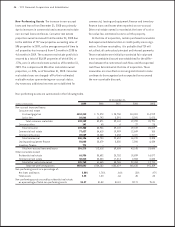

Non-interest expense increased $64.7 million, or 9.5%, in 2009, and $43.9 million, or 6.9%, in 2008,

excluding the Visa indemnication expense and operating lease depreciation. The following table presents the components of

non-interest expense.

Compound Annual

Year Ended December 31, Growth Rate

5-Year

(Dollars in thousands) 2008 2007 2006 2005 2009/2004

Compensation and employee benets $341,203 $346,468 $341,857 $326,526 2.0%

Occupancy and equipment 127,953 120,824 114,618 103,900 5.7

Deposit account premiums 16,888 4,849 5,047 5,822 27.9

Foreclosed real estate and

repossessed assets, net 18,731 5,558 4,068 2,466 135.0

FDIC premiums and assessments 2,990 1,145 1,139 1,080 89.7

Advertising and marketing 19,150 16,829 21,879 19,869 (.3)

Other 153,796 141,167 146,242 139,937 3.7

Subtotal 680,711 636,840 634,850 599,600 5.3

Operating lease depreciation 17,458 17,588 14,347 7,335 64.7

Visa indemnication expense (3,766) 7,696 – – –

Total non-interest expense $694,403 $662,124 $649,197 $606,935 5.8

N.M. Not Meaningful.

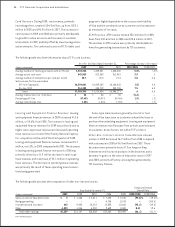

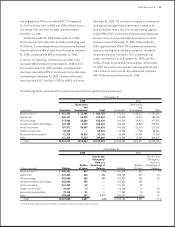

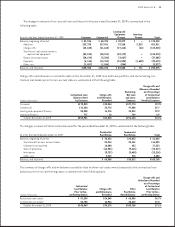

Compensation and Employee Benefits Compensation

and employee benets represented 46.5%, 49.1% and

52.3% of total non-interest expense in 2009, 2008 and

2007, respectively. Compensation and employee benets

increased $15.8 million, or 4.6%, in 2009, compared with

a decrease of $5.3 million, or 1.5%, in 2008. The increases

in compensation and benets in 2009 were primarily due

to increases in leasing and equipment nance and the

inventory nance compensation costs as a result of

expansion and growth and increased employee medical

plan expenses. The decreases in compensation and benets

in 2008 was primarily due to headcount reductions, decreased

performance-based compensation as no executive bonuses

were paid in 2008 and lower benet related costs, partially

offset by expenses from branch expansion and the new

inventory nance business.

Occupancy and Equipment Occupancy and equipment

expenses decreased $1.7 million in 2009 and increased

$7.1 million in 2008. The decrease in 2009 was primarily

due to the closing of six branches. The increase in 2008 was

primarily due to costs associated with branch expansion

and increased real estate taxes.

Deposit Account Premiums Deposit account premium

expense increased $13.8 million to $30.7 million in 2009 and

increased $12 million to $16.9 million in 2008. The increases

in deposit account premium expenses were primarily due to

successful marketing campaigns commencing in June of 2008

which have resulted in increased checking account produc-

tion. New checking accounts grew 24.4% in 2009 compared

with 2008.

Foreclosed Real Estate and Repossessed Assets

Foreclosed real estate and repossessed assets expense

totaled $30.5 million in 2009, compared to $18.7 million

in 2008 and $5.6 million in 2007. The increase in 2009 was

primarily due to the increased number of foreclosed

consumer and commercial real estate properties and

property valuation write-downs.