TCF Bank 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

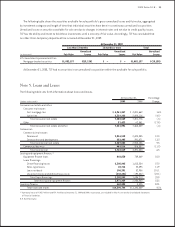

2009 Form 10-K : 57

There were no material commitments to lend additional funds to customers whose loans or leases were classied

as non-accrual at December 31, 2009. At December 31, 2009, accruing loans and leases delinquent for 90 days or more were

$52.1 million, compared with $37.6 million at December 31, 2008.

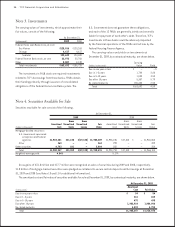

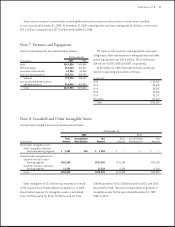

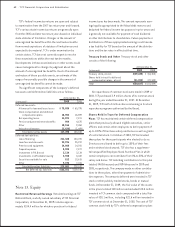

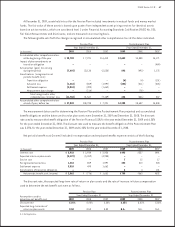

Note 8. Goodwill and Other Intangible Assets

Goodwill and intangible assets are summarized as follows.

At December 31,

2008

Gross Accumulated Net

(In thousands) Amount Amortization Amount

Amortizable intangible assets:

Other intangibles related to

wholesale banking segment $ – $ – $ –

Unamortizable intangible assets:

Goodwill related to retail

banking segment $141,245 $141,245

Goodwill related to wholesale

banking segment 11,354 11,354

Total $152,599 $152,599

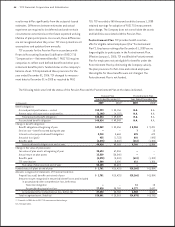

Note 7. Premises and Equipment

Premises and equipment are summarized as follows.

At December 31,

(In thousands) 2008

Land $140,656

Ofce buildings 257,807

Leasehold improvements 60,509

Furniture and equipment 294,790

Subtotal 753,762

Less accumulated depreciation

and amortization 305,936

Total $447,826

TCF leases certain premises and equipment under oper-

ating leases. Net lease expense including utilities and other

operating expenses was $35.3 million, $35.5 million and

$34 million in 2009, 2008 and 2007, respectively.

At December 31, 2009, the total minimum rental pay-

ments for operating leases were as follows.

(In thousands)

2010 $ 27,212

2011 24,645

2012 22,507

2013 21,245

2014 20,171

Thereafter 115,520

Total $231,300

Other intangibles of $1.5 million was recorded as a result

of the acquisition of Fidelity National Capital, Inc. in 2009.

Amortization expense for intangible assets is estimated

to be $172 thousand for 2010, $172 thousand for 2011,

$168 thousand for 2012, $156 thousand for 2013, and $156

thousand for 2014. There was no impairment of goodwill or

intangible assets for the years ended December 31, 2009,

2008, or 2007.