TCF Bank 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 : TCF Financial Corporation and Subsidiaries

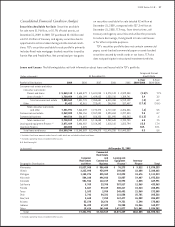

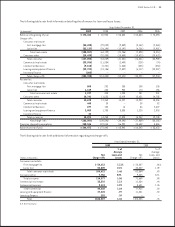

Impaired loans include non-accrual commercial real estate and commercial business loans, equipment

nance loans, inventory nance loans and any restructured consumer real estate loans. The non-accrual impaired loans are

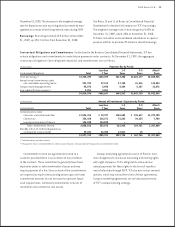

included in the previous disclosures of non-performing assets. Impaired loans are summarized in the following table.

At December 31,

(In thousands) 2008 Change

Non-accrual loans:

Consumer real estate $ 9,216 $ 6,200

Commercial real estate 54,615 23,012

Commercial business 14,088 14,481

Leasing and equipment nance 5,552 8,652

Inventory nance – 771

Subtotal 83,471 53,116

Accruing restructured consumer real estate loans 27,423 225,087

Total impaired loans $110,894 $278,203

Impaired loans totaled $389.1 million and $110.9 million at December 31, 2009, and December 31, 2008, respectively. The

increase in impaired loans from December 31, 2008 was primarily due to a $225.1 million increase in consumer real estate

accruing restructured loans resulting from TCF’s expanded consumer modication activity and an increase in commercial

real estate non-accrual loans. Included in impaired loans were $249.6 million and $25.3 million of accruing restructured

consumer real estate loans less than 90 days past due as of December 31, 2009 and 2008, respectively. The related allowance

for credit losses on impaired loans was $40.6 million at December 31, 2009, compared with $24.6 million at December 31,

2008. The average balance of impaired loans was $219.8 million for 2009 compared with $68.3 million for 2008.

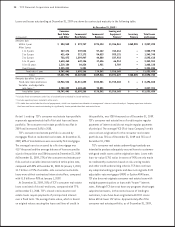

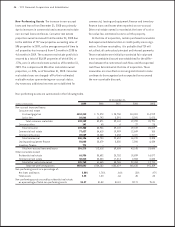

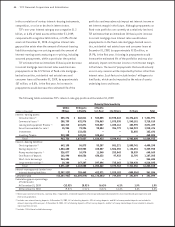

The following table sets forth information regarding TCF’s delinquent loan and lease

portfolio, excluding non-accrual loans and leases. Delinquent balances are determined based on the contractual terms

of the loan or lease.

At December 31,

2008

Percentage

Principal of Loans

(Dollars in thousands) Balances and Leases

Excluding acquired portfolios:

(1) (2)

60-89 days $41,851 .32%

90 days or more 37,619 .28

Total $79,470 .60%

Including acquired portfolios:

(1)

60-89 days $41,851 .32%

90 days or more 37,619 .28

Total $79,470 .60%

(1) Excludes non-accrual loans and leases.

(2) Excludes delinquencies and non-accrual loans in acquired portfolios as delinquency and non-accrual migration in these portfolios is not expected to result in losses

exceeding the credit reserves netted against the loan balances.

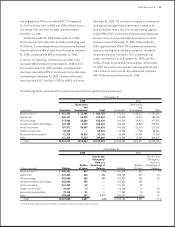

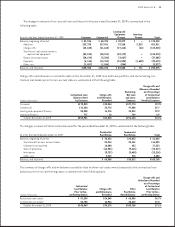

At December 31,

2009 and December 31, 2008, TCF had $17.4 million and

$10.9 million, respectively, of repossessed and returned

equipment held for sale in its leasing and equipment

nance and inventory nance business. The overall

economic environment inuences the level of repossessed

and returned equipment, the demand for these types of

used equipment in the marketplace and the fair value

or ultimate sales prices at disposition. TCF periodically

determines the fair value of this equipment and, if lower

than its recorded basis, makes adjustments.