TCF Bank 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 : TCF Financial Corporation and Subsidiaries

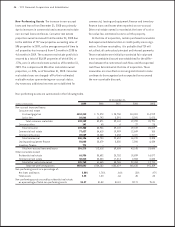

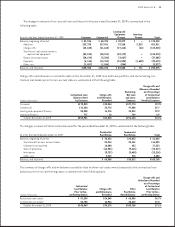

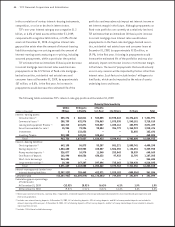

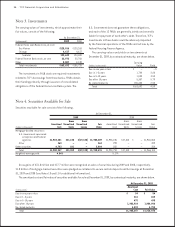

The following table summarizes TCF’s interest-rate gap position at December 31, 2009.

(Dollars in thousands)

Interest-earning assets:

Consumer loans (1)

Commercial loans (1)

Leasing and equipment nance (1)

Securities available for sale (1)

Investments

Inventory nance

Total

Interest-bearing liabilities:

Checking deposits (2)

Savings deposits (2)

Money market deposits (2)

Certicates of deposit

Short-term borrowings

Long-term borrowings (3)

Total

Interest-earning assets (under) over

interest-bearing liabilities

Cumulative gap

Cumulative gap as a percentage

of total assets:

At December 31, 2009

At December 31, 2008 (9.5)% (7.6)% (3.8)% 16.3% 3.4% 3.4%

(1) Based upon contractual maturity, repricing date, if applicable, scheduled repayments of principal and projected prepayments of principal based upon experience and

third-party projections.

(2) Includes non-interest bearing deposits. At December 31, 2009, 18% of checking deposits, 51% of savings deposits, and 54% of money market deposits are included in

amounts repricing within one year. At December 31, 2008, 15% of checking deposits, 60% of savings deposits, and 56% of money market deposits are included in amounts

repricing within one year.

(3) Includes $2.5 billion of callable borrowings.

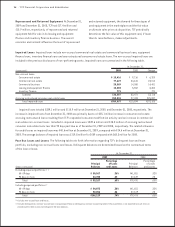

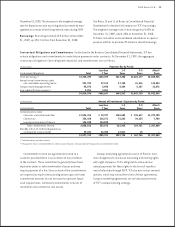

in the correlation of various interest-bearing instruments,

competition, or a rise or decline in interest rates.

TCF’s one-year interest rate gap was a negative $1.2

billion, or 6.6% of total assets at December 31, 2009,

compared with a negative $631 million, or 3.8% of total

assets at December 31, 2008. A negative interest rate

gap position exists when the amount of interest-bearing

liabilities maturing or re-pricing exceeds the amount of

interest-earning assets maturing or re-pricing, including

assumed prepayments, within a particular time period.

TCF estimates that an immediate 25 basis point decrease

in current mortgage loan interest rates would increase

prepayments on the $7.2 billion of xed-rate mortgage-

backed securities, residential real estate loans and

consumer loans at December 31, 2009, by approximately

$57 million, or 8.6%, in the rst year. An increase in

prepayments would decrease the estimated life of the

portfolios and may adversely impact net interest income or

net interest margin in the future. Although prepayments on

xed-rate portfolios are currently at a relatively low level,

TCF estimates that an immediate 100 basis point increase

in current mortgage loan interest rates would reduce

prepayments on the xed-rate mortgage-backed securi-

ties, residential real estate loans and consumer loans at

December 31, 2009, by approximately $132 million, or

19.9%, in the rst year. A slowing in prepayments would

increase the estimated life of the portfolios and may also

adversely impact net interest income or net interest margin

in the future. The level of prepayments that would actually

occur in any scenario will be impacted by factors other than

interest rates. Such factors include lenders’ willingness to

lend funds, which can be impacted by the value of assets

underlying loans and leases.