TCF Bank 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

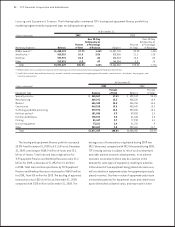

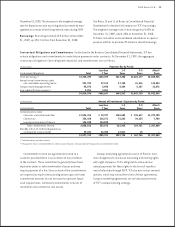

32 : TCF Financial Corporation and Subsidiaries

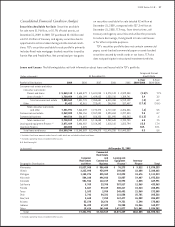

The increase in the consumer real estate allowance

from December 31, 2008 to December 31, 2009, is primarily

due to increased actual and estimated charge-offs due

to continued weakness in residential real estate market

conditions and higher levels of unemployment. The

commercial lending allowance is generally volatile due to

reserves for specic loans based on individual facts and

collateral values as loans migrate to potential problem

loans or to non-accrual. Charge-offs are taken against such

specic reserves. The commercial allowance decreased in

2009 from 2008 due to these factors. The increase in the

leasing and equipment nance allowance was primarily due

to higher charge-offs and the resulting portfolio reserve rate

increases, primarily the result of credit losses on construc-

tion, manufacturing and certain medical equipment.

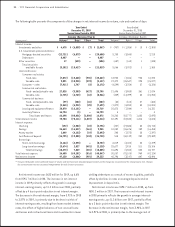

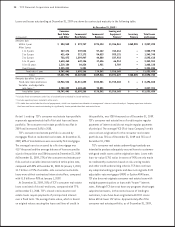

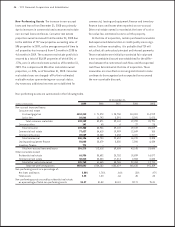

The allocation of TCF’s allowance for loan and lease losses and credit loss reserves are as follows.

Allocations as a Percentage of Total

Loans and Leases Outstanding by Type

At December 31, At December 31,

(Dollars in thousands) 2008 2007 2006 2005 2008 2007 2006 2005

Consumer real estate $ 98,436 $31,596 $13,177 $10,633 1.38% .45% .20% .18%

Consumer other 2,664 2,059 2,211 2,053 4.31 3.05 3.54 3.57

Total consumer 101,100 33,655 15,388 12,686 1.37 .46 .23 .20

Commercial real estate 39,386 25,891 22,662 21,222 1.32 1.01 .95 .92

Commercial business 11,865 7,077 7,503 6,602 2.34 1.27 1.36 1.52

Total commercial 51,251 32,968 30,165 27,824 1.47 1.06 1.03 1.02

Leasing and equipment

nance 20,058 14,319 12,990 15,313 .81 .68 .71 1.02

Inventory nance 33 – – – .75 – – –

Total allowance for

loan and lease losses 172,442 80,942 58,543 55,823 1.29 .66 .52 .55

Other credit loss reserves:

Reserves netted against

portfolio asset balances – – – – N.A. N.A. N.A. N.A.

Reserves for unfunded

commitments 1,510 399 402 189 N.A. N.A. N.A. N.A.

Total credit loss

reserves $173,952 $81,341 $58,945 $56,012 1.30 .66 .52 .55

N.A. Not Applicable.

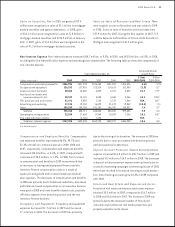

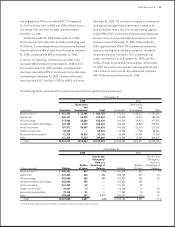

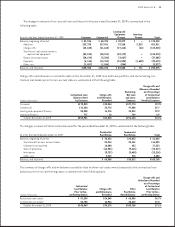

leases and potential problem loans and leases. Included

in this data are numerous portfolio ratios that must be

carefully reviewed in relation to the nature of the underlying

loan and lease portfolios before appropriate conclusions

can be reached regarding TCF or for purposes of making

comparisons to other banks. Most of TCF’s non-performing

assets and past due loans are secured by real estate.

Given the nature of these assets and the related mortgage

foreclosure, property sale and, if applicable, mortgage

insurance claims processes, it can take 18 months or longer

for a loan to migrate from initial delinquency to nal

disposition. This resolution process generally takes much

longer for loans secured by real estate than for unsecured

loans or loans secured by other property primarily due to

state real estate foreclosure laws.