TCF Bank 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

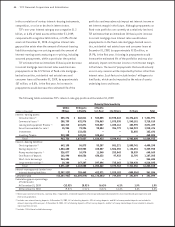

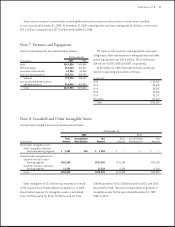

54 : TCF Financial Corporation and Subsidiaries

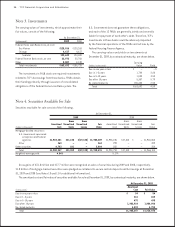

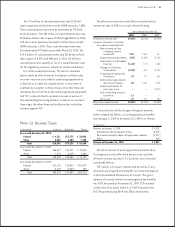

Note 3. Investments

The carrying values of investments, which approximate their

fair values, consist of the following.

At December 31,

(In thousands) 2008

Federal Home Loan Bank stock, at cost:

Des Moines $120,263

Chicago 4,617

Subtotal 124,880

Federal Reserve Bank stock, at cost 22,706

Other 8,139

Total investments $155,725

The investments in FHLB stock are required investments

related to TCF’s borrowings from these banks. FHLBs obtain

their funding primarily through issuance of consolidated

obligations of the Federal Home Loan Bank system. The

U.S. Government does not guarantee these obligations,

and each of the 12 FHLBs are generally jointly and severally

liable for repayment of each other’s debt. Therefore, TCF’s

investments in these banks could be adversely impacted

by the nancial operations of the FHLBs and actions by the

Federal Housing Finance Agency.

The carrying values and yields on investments at

December 31, 2009, by contractual maturity, are shown below.

Carrying

(Dollars in thousands) Value Yield

Due in one year or less $ – –%

Due in 1-5 years 1,700 2.88

Due in 5-10 years 1,000 3.50

Due after 10 years 5,387 5.79

No stated maturity 155,605 2.53

Total $163,692 4.89

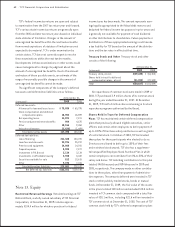

Note 4. Securities Available for Sale

Securities available for sale consist of the following.

At December 31,

2008

Gross Gross

Amortized Unrealized Unrealized Fair

(Dollars in thousands) Cost Gains Losses Value

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal

agencies $1,928,245 $37,310 $ – $1,965,555

Other 299 – – 299

Other securities 250 – – 250

Total $1,928,794 $37,310 $ – $1,966,104

Weighted-average yield 5.17%

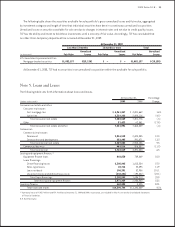

Gross gains of $31.8 million and $17.7 million were recognized on sales of securities during 2009 and 2008, respectively.

$1.8 billion of mortgage-backed securities were pledged as collateral to secure certain deposits and borrowings at December

31, 2009 and 2008 (see Notes 10 and 11 for additional information).

The amortized cost and fair value of securities available for sale at December 31, 2009, by contractual maturity, are shown below.

(In thousands)

Due in one year or less

Due in 1-5 years

Due in 5-10 years

Due after 10 years

No stated maturity

Total