TCF Bank 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 : TCF Financial Corporation and Subsidiaries

charge legislation is pending that could impact our

checking account products. We are staying close to

the topic and will take careful steps to manage our way

through any regulatory or legislative changes.

Regulatory reform following the financial crisis was the

government’s main focus in 2009 and into 2010. Members

of Congress have been busy pursuing several legislative

changes that could significantly impact the banking

industry. The proposed bill to limit interchange fees could

impact the banking industry; however, I do not believe

this bill will pass in the Senate as it is a concern between

merchants and banks without a consumer advocate.

The industry could also be impacted by the creation of

a centralized regulatory agency, the Consumer Financial

Protection Agency, by adding undue regulatory burden.

We continue to closely monitor developments on the

regulatory front and are committed to remaining innovative

in both our product and service offerings that fall within the

parameters of Congressional and regulatory requirements.

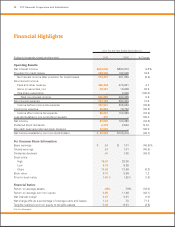

Revenue:

TCF’s total revenue in 2009 was $1.2 billion, up 6 percent,

from last year. Net interest income increased 7 percent

as a result of our aggressive deposit pricing strategy and

the favorable yields we received on our loans and leases,

and non-interest income increased 6 percent from 2008.

We saw some improvement in deposit fee income in

2009; however, volume levels remained low as customers

continued to be mindful of their spending and saved more.

This trend in customer behavior also impacted TCF’s card

revenue which totaled $104.8 million in 2009 and was

essentially flat from 2008. Our large checking account

base contributed to TCF’s ranking as the 10th largest

Visa®

Classic debit card issuer in the United States.

A strong fee category in 2009 was leasing and

equipment finance revenues, which totaled $69.1 million,

up 25 percent, from the prior year. Both operating lease

revenues and customer-driven sales-type lease revenues

increased in 2009. We also saw an increase in new

originations on equipment placed in service.

Expenses:

TCF was very efficient in managing its operating expenses

in 2009. We continued to place emphasis on our core

businesses of deposit gathering and loan and lease

production. As a result, we streamlined our day-to-day

operations and reorganized the company by profit

centers within business lines. We believe these actions

reduce redundancies, improve efficiencies and create

a highly responsive and performance-driven culture.

Unfortunately, these decisions were made at the cost

of a number of long-term and loyal employees. I applaud

those employees that have assumed additional duties as

a result of the restructuring and look to all employees to

continue to find ways to contribute to the bottom line

while carefully monitoring expenses.

The year 2009 also presented some unusual charges

that fell outside of core operating expenses. First, the

Federal Deposit Insurance Corporation required a special

FDIC insurance assessment of $8.2 million in the second

quarter and subsequently increased our insurance

premium rate. Second, foreclosed real estate and

repossessed asset expenses increased $11.8 million, or

63 percent, from last year as a result of increased levels of

commercial and consumer real estate owned properties.

TCF’s income tax expense was $45.9 million for 2009,

or 35 percent of pre-tax income. Income tax expense

for 2009 included a $4.2 million decrease in income tax

expense related to favorable developments in uncertain

tax positions, partially offset by a slight increase in the

effective income tax rate.

0908070605

$996

$1,027

$1,092

$1,092

$1,159

Total Revenue

Millions of Dollars

+6% annual growth rate (’09 vs. ’08)

Fees and Other Revenue

Net Interest Income

0908070605

$550

$594

$633

Net Interest Income

Millions of Dollars

+7% annual growth rate (’09 vs. ’08)

$518

$538