TCF Bank 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 : TCF Financial Corporation and Subsidiaries

results may differ signicantly from the actuarial-based

estimates. Differences between estimates and actual

experience are required to be deferred and under certain

circumstances amortized over the future expected working

lifetime of plan participants. As a result, these differences

are not recognized when they occur. TCF closely monitors all

assumptions and updates them annually.

TCF accounts for the Pension Plan in accordance with

Financial Accounting Standard Codication (FASC) 715

“Compensation — Retirement Benets”. FASC 715 requires

companies to reect each dened benet and other post-

retirement benets plan’s funded status on the company’s

balance sheet. TCF implemented these provisions for the

year ended December 31, 2006. TCF changed its measure-

ment date to December 31 in 2008 as required by FASC

715. TCF recorded a $65 thousand credit to January 1, 2008

retained earnings for adoption of FASC 715 measurement

date change. The Company does not consolidate the assets

and liabilities associated with the Pension Plan.

TCF provides health care ben-

ets for eligible retired employees (the “Postretirement

Plan”). Employees retiring after December 31, 2009 are no

longer eligible to participate in the Postretirement Plan.

Effective January 1, 2000, TCF modied the Postretirement

Plan for employees not yet eligible for benets under the

Postretirement Plan by eliminating the Company subsidy.

The plan provisions for full-time and retired employees

then eligible for these benets were not changed. The

Postretirement Plan is not funded.

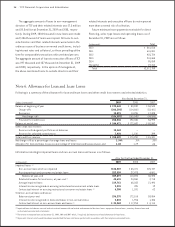

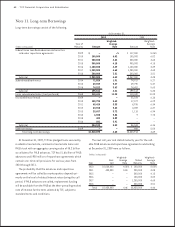

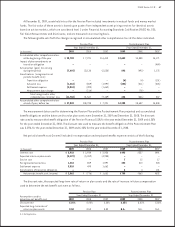

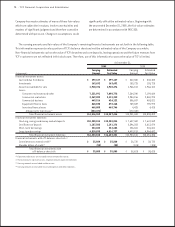

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated.

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2008(1) 2008(1)

Benet obligation:

Accrued participant balance — vested $ 53,156 N.A.

Present value of future service and benets (4,107) N.A.

Total projected benet obligation $ 49,049 N.A.

Accumulated benet obligation $ 49,049 N.A.

Change in benet obligation:

Benet obligation at beginning of year $ 52,456 $ 9,491

Service cost — benets earned during the year – 15

Interest cost on projected benet obligation 3,668 670

Actuarial loss (gain) (1,733) (492)

Benets paid (5,342) (1,300)

Projected benet obligation at end of year 49,049 8,384

Change in fair value of plan assets:

Fair value of plan assets at beginning of year 67,506 –

Actual return on plan assets (28,540) –

Benets paid (5,342) (1,300)

TCF contributions 5,000 1,300

Fair value of plan assets at end of year 38,624 –

Funded status of plans at end of year $(10,425) $(8,384)

Amounts recognized in Statements of Financial Condition:

Prepaid (accrued) benet cost at end of year $(10,425) $(8,384)

Amounts not yet recognized in net periodic benet cost and included

in accumulated other comprehensive loss, before tax:

Transition obligation – 15

Accumulated actuarial net loss 38,788 3,637

Accumulated other comprehensive loss, before tax 38,788 3,652

Total recognized asset (liability) $ 28,363 $(4,732)

(1) 15 months in 2008 due to FASC 715 measurement date change.

N.A. Not Applicable.