TCF Bank 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Form 10-K : 75

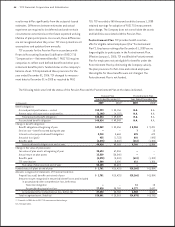

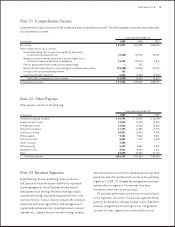

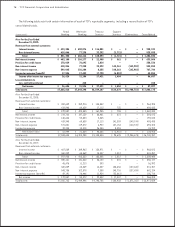

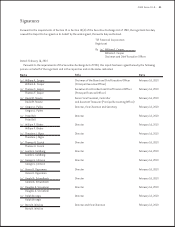

Note 21. Comprehensive Income

Comprehensive income is the total of net income and other comprehensive income. The following table summarizes the components

of comprehensive income.

Year Ended December 31,

(In thousands) 2008 2007

Net income $128,958 $266,808

Other comprehensive (loss) income:

Unrealized holding (losses) gains arising during the period

on securities available for sale 69,754 30,237

Recognized pension and postretirement actuarial gain (loss),

settlement expense and transition obligation (30,974) 8,822

Pension and postretirement measurement date change 293 –

Reclassication adjustment for securities gains included in net income (16,066) (13,278)

Foreign currency translation adjustment 1 –

Income tax benet (expense) (8,645) (8,910)

Total other comprehensive (loss) income 14,363 16,871

Comprehensive income $143,321 $283,679

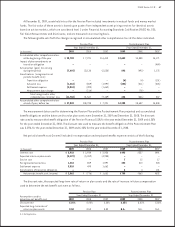

Note 22. Other Expense

Other expense consists of the following.

Year Ended December 31,

(In thousands) 2008 2007

Card processing and issuance $ 19,262 $ 18,134

Deposit account losses 14,709 17,629

Postage and courier 13,380 13,663

Telecommunications 11,860 11,790

Outside processing 10,450 9,296

Ofce supplies 9,664 9,581

Professional fees 7,474 6,939

Credit insurance – –

ATM processing 6,881 8,647

Separation costs 10,005 1,411

Other 46,345 51,773

Total other expense $150,030 $148,863

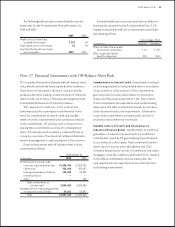

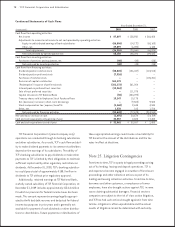

Note 23. Business Segments

Retail Banking, Wholesale Banking, Treasury Services

and Support Services have been identied as reportable

operating segments. Retail Banking includes branch

banking and retail lending. Wholesale Banking includes

commercial banking, leasing and equipment nance and

inventory nance. Treasury Services includes the Company’s

investment and borrowing portfolios and management of

capital, debt and market risks, including interest-rate and

liquidity risks. Support Services includes holding company

and corporate functions that provide data processing, bank

operations and other professional services to the operating

segments. In 2009, TCF changed the management structure

and therefore its segments. Prior periods have been

restated to reect the current structure.

TCF evaluates performance and allocates resources based

on the segments’ net income. The business segments follow

generally accepted accounting principles as described in the

Summary of Signicant Accounting Policies. TCF generally

accounts for inter-segment sales and transfers at cost.