TCF Bank 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 : TCF Financial Corporation and Subsidiaries

• Changes in customer behavior from the slowing

economy and advances in technology could further

impact fee revenue. In addition, changes to our product

and service offerings in response to potential legislative

changes could have an impact on customer banking

preferences in the future.

• Growth expectations of our new inventory finance

business may not be achieved. This new line of business

has been very successful for TCF; however, the ability

to retain existing business relationships and attract new

customers will become challenging as competitors

re-enter the market.

• A further reduction of the public’s perception of banks.

When public perception sours as a result of bad behavior

from some of the largest players, smaller community

banks like TCF are the ones at risk of being impacted the

most. Therefore, it is important we continue to stick to

our knitting and provide products and services that appeal

to all people.

TCF has prudently managed these types of risks in

the past and we believe we are adequately prepared to

manage them in the future.

In Closing:

TCF remains a safe and sound financial institution.

Our capital position remains strong and we have access

to the capital markets to raise additional equity or debt.

We have ample liquidity to conduct business. Our commit-

ment to a conservative corporate philosophy has proven

itself time and again over the past 25 years. I am proud

we have held tight to our principles and, as a result, TCF

has remained profitable during a very difficult time while

many others fell short. TCF has a business model that

works and we continue to look for opportunities to create

and deliver stockholder value.

We also continue to have a mutuality of interest with

our stockholders. Our senior management and board

of directors own over 8.7 million shares, or 7 percent

of TCF stock. Eighty-three percent of our match-eligible

employees participate in TCF’s Employees Stock Purchase

Plan, which at year-end held over 8.2 million shares.

Our compensation systems are largely stock based.

I would like to take this opportunity to thank the board

of directors for their continued dedication, wise counsel

and support of TCF. It was very much appreciated in

2009. During the year, we welcomed Vance Opperman

and Peter Bell to TCF’s board membership. Vance has a

wealth of knowledge and experience in law and financial

services and we welcome his insights to assist TCF

in our continued growth and success. Peter previously

worked at TCF and has expertise in government

services, business development, transportation, higher

education and housing. Both Vance and Peter share a

passion for community service which is unprecedented

and highly commendable. We look forward to their

guidance and counsel.

I would also like to give a special thanks to our employ-

ees for their hard work and efforts during another very

challenging year. Their exceptional abilities, commitment

and energy make everything happen at TCF. I am proud

of the TCF Team and its accomplishments.

Thank you for your continued support and investment

in TCF.

William A. Cooper

Chairman and Chief Executive Officer

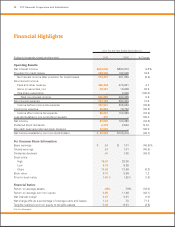

0908070605

$12.3

$13.3

$14.6

Total Loans & Leases

Billions of Dollars

+9% annual growth rate (’09 vs. ’08)

$10.2

$11.3