TCF Bank 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 : TCF Financial Corporation and Subsidiaries

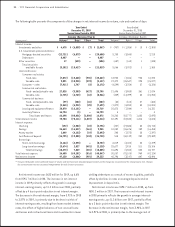

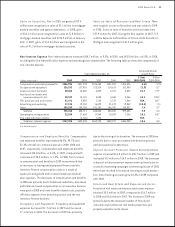

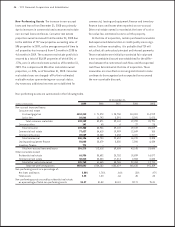

Retail Lending TCF’s consumer real estate loan portfolio

represents approximately half of its total loan and lease

portfolio. The consumer real estate portfolio was at in

2009 and increased 3.6% in 2008.

TCF’s consumer real estate portfolio is secured by

mortgages led on residential real estate. At December 31,

2009, 68% of loan balances were secured by rst mortgages.

The average loan size secured by a rst mortgage was

$117 thousand and the average balance of loans secured by

a junior lien position was $36 thousand at December 31, 2009.

At December 31, 2009, 27% of the consumer real estate port-

folio carried a variable interest rate tied to the prime rate,

compared with 25% at December 31, 2008. At January 1, 2010,

$1.7 billion or 91% of variable-rate consumer real estate

loans were at their contractual interest rate oor, compared

with $1.8 billion or 98% at January 1, 2009.

At December 31, 2009, 76% of TCF’s consumer real estate

loans consisted of closed-end loans, compared with 77%

at December 31, 2008. TCF’s closed-end consumer real

estate loans require payments of principal and interest

over a xed term. The average home value, which is based

on original values securing the loans and lines of credit in

this portfolio, was $250 thousand as of December 31, 2009.

TCF’s consumer real estate lines of credit require regular

payments of interest and do not require regular payments

of principal. The average FICO (Fair Isaac Company) credit

score at loan origination for the consumer real estate

portfolio was 725 as of December 31, 2009 and 723 as of

December 31, 2008.

TCF’s consumer real estate underwriting standards are

intended to produce adequately secured loans to customers

with good credit scores at the origination date. Loans with

loan-to-value (LTV) ratios in excess of 90% are only made

to creditworthy customers based on risk scoring models

and other credit underwriting criteria. TCF does not have

any subprime lending programs and does not originate 2/28

adjustable-rate mortgages (ARM) or Option ARM loans.

TCF also does not originate consumer real estate loans with

multiple payment options or loans with “teaser” interest

rates. Although TCF does not have any programs that target

subprime borrowers, in the normal course of lending to

customers, loans have been originated with FICO scores

below 620 at lower LTV ratios. Approximately 6% of the

consumer real estate portfolio, as of December 31, 2009,

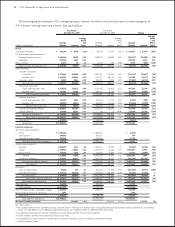

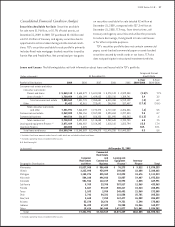

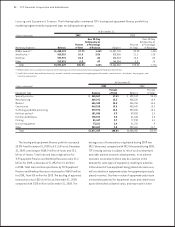

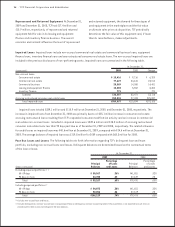

Loans and leases outstanding at December 31, 2009 are shown by contractual maturity in the following table.

(3)

(In thousands) (2)

Amounts due:

Within 1 year

After 1 year:

1 to 2 years

2 to 3 years

3 to 5 years

5 to 10 years

10 to 15 years

Over 15 years

Total after 1 year

Total

Amounts due after 1 year on:

Fixed-rate loans and leases

Variable- and adjustable-

rate loans (1)

Total after 1 year

(1) Excludes xed-term amounts under lines of credit which are included in closed-end loans.

(2) Excludes operating leases included in other assets.

(3) This table does not include the effect of prepayments, which is an important consideration in management’s interest-rate risk analysis. Company experience indicates

that loans and leases remain outstanding for signicantly shorter periods than their contractual terms.