TCF Bank 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Annual Report : 9

and card service fees. Litigation against Visa could also

have an impact on future card revenue. Regulatory issues

and the related compliance burden continue to increase

and impact TCF’s expense. We continue to monitor these

developments but a growing amount of time and dollars

are being spent on this effort.

• Economic climate, with value declines in both homes

and commercial real estate, and rising unemployment

are major risks for all banks, including TCF.

• In the current state of the economy, the Federal and

most state governments cannot fund their spending

initiatives. Tax increases on businesses, including TCF,

or individuals to fill the spending gaps in an attempt to

balance their budgets is a risk on multiple fronts to TCF.

• Managing interest rate risk and the continued low

levels of interest rates with an eye toward the possibility

of rapidly increasing inflation continues to be very

challenging.

• Potential reductions in our borrowing capacity because

of restrictions put on the Federal Home Loan Banks or

the Federal Reserve Discount Window could reduce our

liquidity and could inhibit growth or force higher deposit

costs. Growing deposits reduces this risk.

Deposit gathering and loan and lease production are

the bread and butter of TCF, and a high priority for our

entire management team in 2010. Checking account

growth provides a low-cost funding base and drives

future deposit fee income.

• Carefully monitor credit quality. Our objective in this

area is to remain conservative through controlled and

thorough credit evaluation, secured lending, and prompt

accounting for credit losses and the related provisioning.

I expect home values to stabilize and the economy to

begin to improve during the year which should reduce

the rate of loan and lease defaults and reduce credit

losses. Credit quality, however, will largely depend on

the viability of the U.S. economy.

• Use capital wisely. TCF has maintained a solidly

capitalized structure for many years. If in 2010 regulators

increase their capital standards on banks, we will react

accordingly. We will always be good stewards of our

stockholders’ capital and think long-term. Prudent capital

management, which includes making wise investments,

is a top priority.

• Stay innovative in product and service offerings within

the constraints of new regulations. We need to be

flexible and move quickly in response to potential

government mandated controls and restrictions placed on

our products and services, and protect our future profits.

• Continue to review and control expenses. In this

difficult operating environment, it is important to focus on

expense control and in 2010, it will be a team effort of all

TCF employees. We will continue to identify areas within

our business lines to improve processes and efficiencies.

• Continue our longstanding commitment to strong

corporate governance. Our customers and stock holders

entrust us with their money and confidential information

and, therefore, our management practices demand high

standards of ethics. Reputation for honesty and integrity

continues to rank at the top of our priorities.

Risks to Our Business Strategy:

• Congressional and regulatory actions could have an

impact on our business and our ability to generate future

fee income. We do not know what Congress will do next;

they may impose additional regulations on checking fees

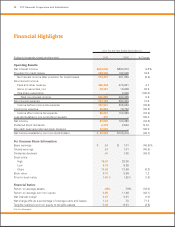

0908070605

$9.1

$9.8

$9.6

$10.2

$11.6

Total Deposits

Billions of Dollars

+13% annual growth rate

(’09 vs. ’08)

Certificates of Deposit

Core Deposits

0908070605

2,137

2,240

2,226

2,265

2,473

Checking &

Savings Accounts

Thousands

+9% annual growth rate (’09 vs. ’08)

Saving Accounts

Checking Accounts