Suzuki 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 49

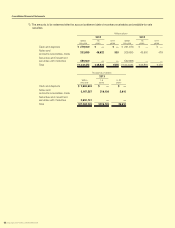

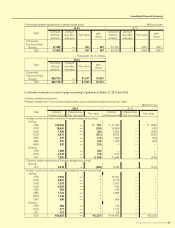

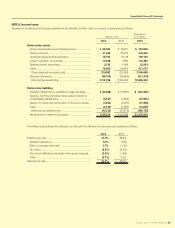

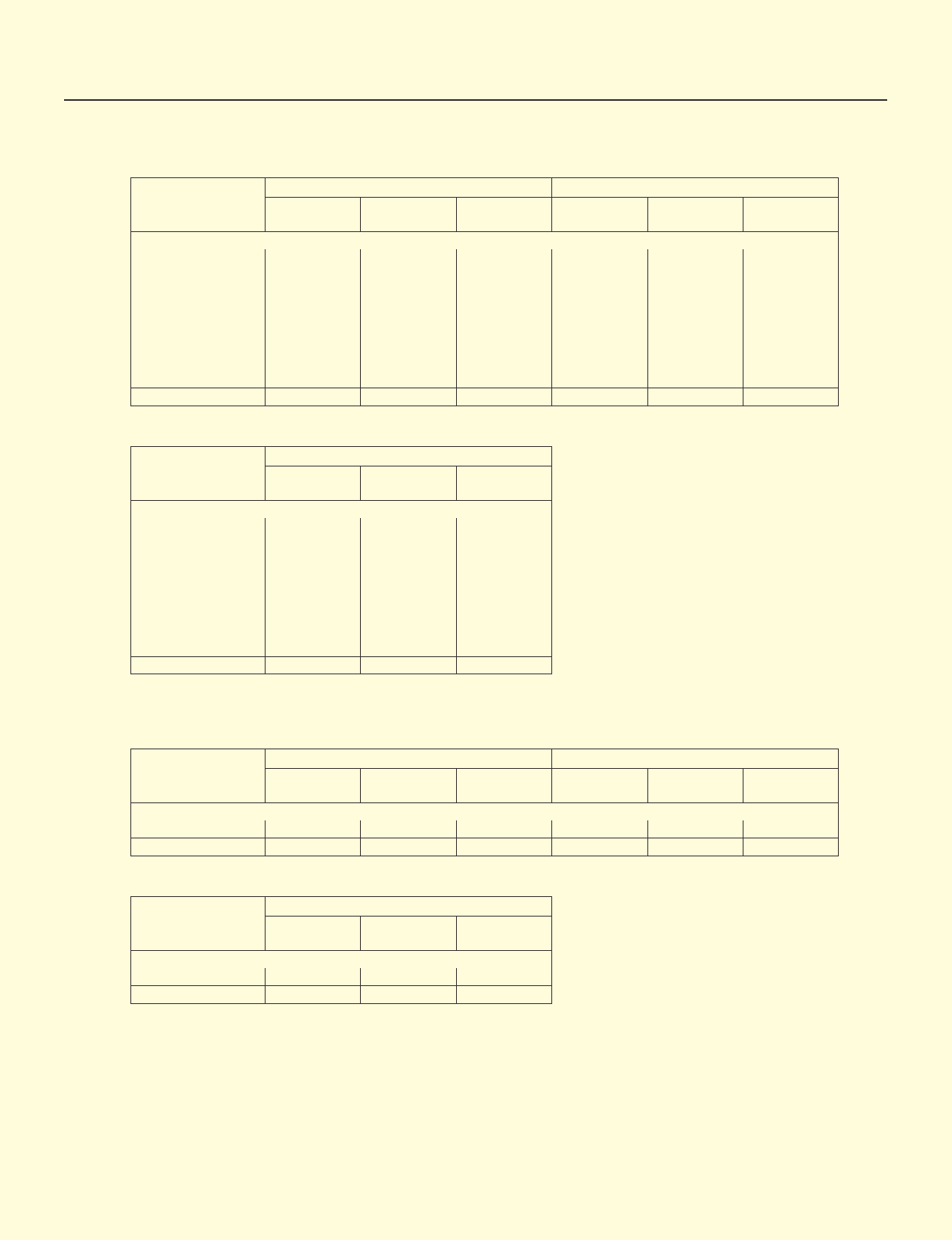

Cross currency interest rate swap transactions

Principal hedged item : long term debt

Millions of yen

Type

2013 2012

Contract/

notional amount

Amount due

after one year Fair value

Contract/

notional amount

Amount due

after one year Fair value

Principle hedge accounting

Pay xed

receive oating

Pay JPY

receive USD

¥121,000 ¥121,000 ¥3,910 ———

Pay xed

receive oating

Pay IDR

receive USD

1,896 675 (35)———

Total ¥122,896 ¥121,675 ¥3,875 ———

Thousands of U.S. dollars

Type

2013

Contract/

notional amount

Amount due

after one year Fair value

Principle hedge accounting

Pay xed

receive oating

Pay JPY

receive USD

$1,286,549 $1,286,549 $41,577

Pay xed

receive oating

Pay IDR

receive USD

20,160 7,180 (376)

Total $1,306,710 $1,293,730 $41,201

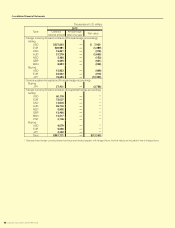

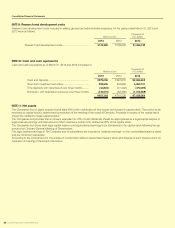

Commodity transactions

Principal hedged item : raw materials and supplies

Millions of yen

Type

2013 2012

Contract/

notional amount

Amount due

after one year Fair value

Contract/

notional amount

Amount due

after one year Fair value

Commodity futures contract (Principle hedge accounting)

Buying ¥536 —¥(41)¥931 —¥58

Total ¥536 —¥(41)¥931 —¥58

Thousands of U.S. dollars

Type

2013

Contract/

notional amount

Amount due

after one year Fair value

Commodity futures contract (Principle hedge accounting)

Buying $5,708 —$(437)

Total $5,708 —$(437)