Suzuki 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management policy

SUZUKI MOTOR CORPORATION 25

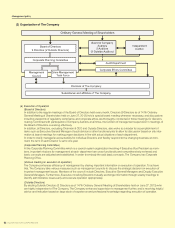

(d) System to ensure proper business operation of the corporate group

To ensure a proper business operation of the corporate group which consists of The Company and its subsidiaries, The Com-

pany has established the “Rules of Business Control Supervision”. It is revised whenever necessary. The subsidiaries report

to The Company on their business operation and consult with The Company on important matters in accordance with those

rules, and departments in charge give guidance and advice to them to enhance their management structure. And our audit

department helps to make rules for the subsidiaries, conducts guidance, supporting and auditing for their regulatory compli-

ance. It also promotes efciency and standardization of their business.

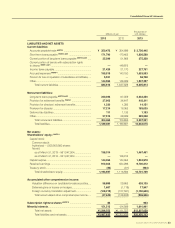

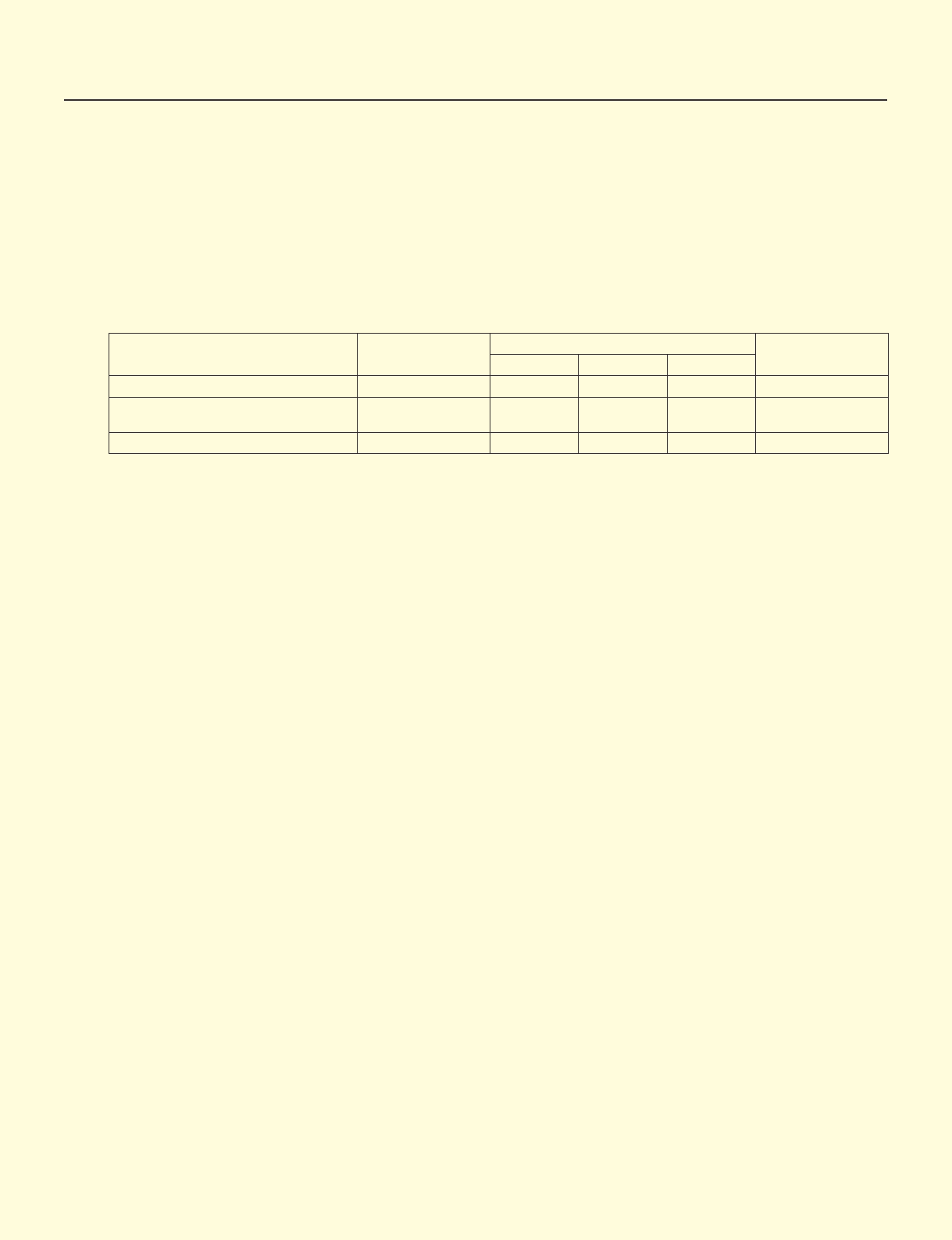

(4)RemunerationforDirectorsandCompanyAuditorsforcurrentscalyear

(a) Remuneration paid to Directors and Company Auditors is as follows:

(Amount of remuneration: million yen, Number of payees: person)

Classication Total amount of

remuneration

Amount of each type of remuneration Number of payees

Basic pay Stock option Bonus

Directors (excluding Outside Directors) 604 343 73 187 10

Company Auditors

(excluding Outside Company Auditors) 53 38 - 15 3

Outside Directors/Company Auditors 24 17 - 7 7

Notes: 1. The amount of remuneration limit for Directors (¥80 million per month) was resolved at the 135th Ordinary General Meeting of

Shareholders held on June 28, 2001.

2. The amount of remuneration limit for Company Auditors (¥8 million per month) was resolved at the 123rd Ordinary General Meeting

of Shareholders held on June 29, 1989.

3. The maximum amount of remuneration for Directors for stock options as compensation (¥170 million per year) was resolved at the

146th Ordinary General Meeting of Shareholders held on June 28, 2012.

4. The above-mentioned bonuses are recorded as provision for Directors’ bonuses at the end of current scal year and treated as

expenses of current scal year.

5. The above includes 3 Company Auditors who retired at the end of the 146th Ordinary General Meeting of Shareholders held on

June 28, 2012.

6. In addition to the above, ¥7 million was paid to 1 retired Director and ¥9 million was paid to 2 retired Outside Company Auditors as

retirement benets for Directors and Company Auditors under the resolution at the 140th Ordinary General Meeting of Shareholders

held on June 29, 2006.

7. The following information is disclosed in 147th annual securities report

• Total amount of consolidated remuneration paid to persons who received consolidated remuneration of ¥100 million or more each.

(b) Policy for determination of the amount of remuneration for Directors and Company Auditors

Remuneration for Directors/Company Auditors consists of basic remuneration, bonuses and stock options with respect to

Directors, and basic remuneration and bonuses with respect to Company Auditors.

While The Company discontinued its retirement benets plan for Directors and Company Auditors at the 140th Ordinary Gen-

eral Meeting of Shareholders, held on June 29, 2006, it has introduced the granting of stock options as compensation with a

view toward strengthening Directors’ connection to The Company’s performance and stock price and ensuring that Directors

share with shareholders not only the benets of any increases in the stock price, but also the risks of any declines, pursuant to

the approval granted at the 146th Ordinary General Meeting of Shareholders, held on June 28, 2012.

(Director)

As for basic remuneration, the amount of remuneration limit (monthly amount) for all Directors shall be determined by a resolu-

tion of an Ordinary General Meeting of Shareholders, and the amount of remuneration for each Director shall be determined

by the representative Director who is authorized by the Board of Directors in consideration of the duties and responsibilities of

each Director to enhance the corporate value in each scal year and on a mid-and long-term basis.

As for bonuses, the Board of Directors will decide on a proposal regarding bonus payments to Directors/Company Auditors

in consideration of the management environment and The Company’s performance in each scal year, and the representative

Director who is authorized by the Board of Directors will decide, pursuant to the approval of an Ordinary General Meeting of

Shareholders concerning the total amount of the bonus, the amount of the bonus for each Director that reects each Director’s

achievement of his or her duties and responsibilities.

As for granting stock options as compensation, the Board of Directors will decide, pursuant to the approval of an Ordinary

General Meeting of Shareholders concerning the maximum amount of remuneration, etc. with respect to the stock acquisition

rights in each scal year, the allocation of stock acquisition rights to each Director (excluding Outside Directors).