Suzuki 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

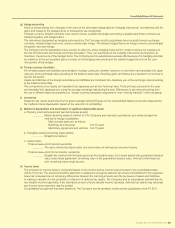

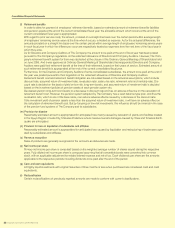

(l) Retirementbenets

In order to allow for payment of employees’ retirement benets, based on estimated amount of retirement benets liabilities

and pension assets at the end of the current consolidated scal year, the allowable amount which occurs at the end of the

current consolidated scal year is appropriated.

With regard to prior service costs, the amount, prorated on a straight line basis over the certain period within average length

of employees’ remaining service years at the time when it occurs, is treated as expense. As for the actuarial differences, the

amounts prorated on a straight line basis over the certain period within average length of employees’ remaining service years

in each scal year in which the differences occur are respectively treated as expenses from the next term of the scal year in

which they arise.

As for Directors and Company Auditors of The Company, the amount to be paid at the end of scal year had been posted

pursuant to The Company’s regulations on the retirement allowance of Directors and Company Auditors. However, The Com-

pany’s retirement benet system for them was abolished at the closure of the Ordinary General Meeting of Shareholders held

on June 2006. And it was approved at Ordinary General Meeting of Shareholders that reappointed Directors and Company

Auditors were paid their retirement benet at the time of their retirement, based on their years of service. Estimated amount of

such retirement benets is appropriated at the end of the current consolidated scal year.

Furthermore, for the Directors and Company Auditors of some consolidated subsidiaries, the amount to be paid at the end of

the year was posted pursuant to their regulation on the retirement allowance of Directors and Company Auditors.

Retirement benet cost and retirement benet obligation are calculated based on the actuarial assumptions, which include

discount rate, assumed return of investment ratio, revaluation ratio, salary rise ratio, retirement ratio and mortality ratio. Dis-

count rate is decided on the basis of yield on low-risk, long-term bonds, and assumed return of investment ratio is decided

based on the investment policies of pension assets of each pension system etc.

Decreased yield on long-term bond leads to a decrease in discount rate and has an adverse inuence on the calculation of

retirement benet cost. However, the pension system adopted by The Company has a cash balance type plan, and thus the

revaluation ratio, which is one of the base ratios, can reduce adverse effects caused by a decrease in the discount rate.

If the investment yield of pension assets is less than the assumed return of investment ratio, it will have an adverse effect on

the calculation of retirement benet cost. But by focusing on low-risk investments, this inuence should be minimal in the case

of the pension fund systems of The Company and its subsidiaries.

(m) Provision for disaster

Reasonably estimated amount is appropriated for anticipated loss mainly caused by relocation of plants and facilities located

in the Ryuyo Region in Iwata City, Shizuoka Prefecture where massive tsunami damages caused by Tokai and Tonankai Earth-

quake are anticipated.

(n) Provisionforlossonliquidationofsubsidiariesandafliates

Reasonably estimated amount is appropriated for anticipated loss caused by liquidation and restructuring of businesses oper-

ated by subsidiaries and afliates.

(o) Revenue recognition

Sales of products are generally recognized in the accounts as deliveries are made.

(p) Net income per share

Primary net income per share is computed based on the weighted average number of shares issued during the respective

years. Fully diluted net income per share is computed assuming that all convertible bonds were converted into common

stock, with an applicable adjustment for related interest expense and net of tax. Cash dividends per share are the amounts

applicable to the respective periods including dividends to be paid after the end of the period.

(q) Cash and cash equivalents

All highly liquid investments with original maturities of three months or less when purchased are considered cash and cash

equivalents.

(r) Reclassication

Certain reclassications of previously reported amounts are made to conform with current classications.