Suzuki 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

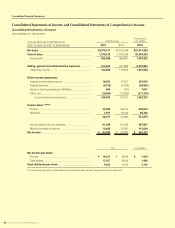

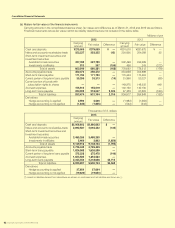

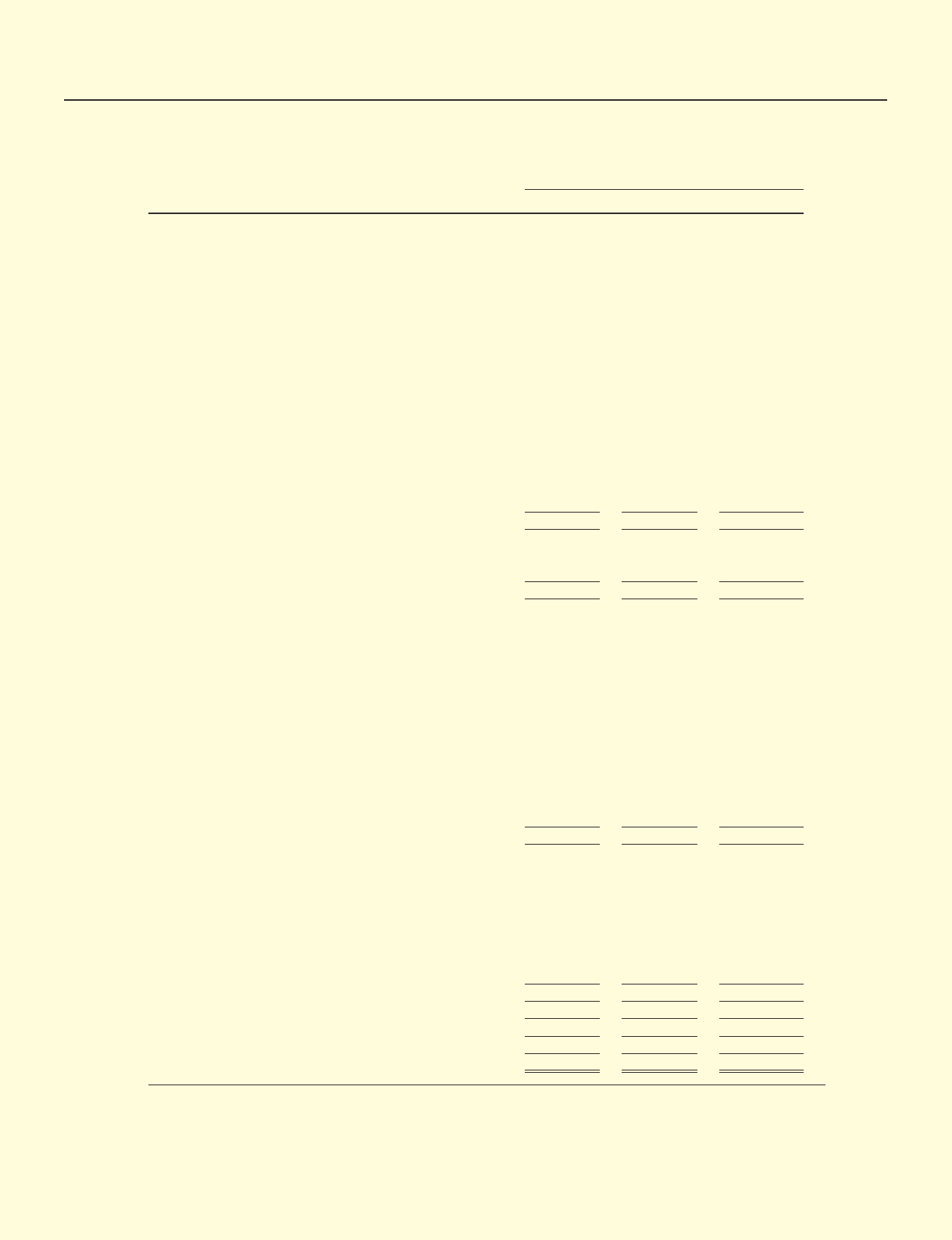

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 37

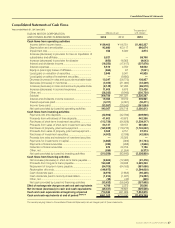

Consolidated Statements of Cash Flows

Years ended March 31, 2013 and 2012

SUZUKI MOTOR CORPORATION

AND CONSOLIDATED SUBSIDIARIES

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Cashowsfromoperatingactivities

Income before income taxes ............................................. ¥139,403 ¥116,751 $1,482,227

Depreciation and amortization .......................................... 93,680 103,117 996,074

Impairment loss ................................................................. 458 6,030 4,874

Increase (decrease) in provision for loss on liquidation of

subsidiaries and afliates .................................................. 5,521 —58,708

Increase (decrease) in provision for disaster (850)18,065 (9,043)

Interest and dividends income .......................................... (19,550)(17,617)(207,876)

Interest expenses .............................................................. 5,510 4,750 58,592

Equity in (earnings) losses of afliates .............................. (664)67 (7,061)

Loss (gain) on valuation of securities ............................... 3,849 5,341 40,925

Loss (gain) on sales of investment securities ................... —(9,650)—

Decrease (increase) in notes and accounts receivable-trade

10,247 (58,773)108,957

Decrease (increase) in inventories ................................... (3,029)(21,060)(32,209)

Increase (decrease) in notes and accounts payable-trade

(8,142)97,280 (86,579)

Increase (decrease) in accrued expenses ...................... 11,608 6,676 123,428

Other, net ............................................................................ (28,282)(9,945)(300,720)

Subtotal 209,759 241,031 2,230,297

Interest and dividends income received .......................... 19,466 19,312 206,981

Interest expenses paid ...................................................... (5,211)(4,081)(55,411)

Income taxes paid ............................................................. (33,957)(29,543)(361,054)

Net cash provided by (used in) operating activities 190,057 226,718 2,020,813

Cashowsfrominvestingactivities

Payments into time deposits ............................................. (32,908)(42,786)(349,906)

Proceeds from withdrawal of time deposits...................... 41,603 40,875 442,356

Purchases of short-term investment securities ................ (113,726)(84,628)(1,209,217)

Proceeds from sales of short-term investment securities

64,127 59,157 681,843

Purchases of property, plant and equipment ................... (163,929)(119,210)(1,743,002)

Proceeds from sales of property, plant and equipment ... 3,505 3,751 37,274

Purchases of investment securities .................................. (4,002)(2,188)(42,559)

Proceeds from sales and redemption of investment securities

. —25,025 —

Payments for investments in capital ................................. (4,865)(384)(51,734)

Payments of loans receivable ........................................... (436)(458)(4,636)

Collection of loans receivable ........................................... 673 28,759 7,156

Other, net ............................................................................ (599)(1,554)(6,373)

Net cash provided by (used in) investing activities (210,559)(93,643)(2,238,800)

Cashowsfromnancingactivities

Net increase (decrease) in short-term loans payable ...... (8,603)(12,480)(91,476)

Proceeds from long-term loans payable .......................... 190,482 29,948 2,025,330

Repayment of long-term loans payable ........................... (54,708)(64,165)(581,696)

Redemption of bonds ........................................................ (149,975)—(1,594,630)

Cash dividends paid ......................................................... (8,975)(7,853)(95,435)

Cash dividends paid to minority shareholders ................. (1,814)(1,947)(19,292)

Other, net ............................................................................ (38)(42)(405)

Net cash provided by (used in) nancing activities (33,632)(56,540)(357,605)

Effectofexchangeratechangesoncashandcashequivalents

4,706 2,072 50,046

Netincrease(decrease)incashandcashequivalents (49,427)78,607 (525,546)

Cashandcashequivalentsatbeginningofperiod 710,530 631,923 7,554,815

Cashandcashequivalentsatendofperiod *NOTE 10 ¥661,102 ¥710,530 $7,029,269

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.