Suzuki 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 SUZUKI MOTOR CORPORATION

Financial review

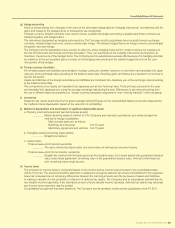

(4)Fluctuationsofexchangeratesandinterestrates

We export motorcycles, automobiles, outboard motors and related parts to various countries in the world from Japan. In addition,

we export those products and parts from the overseas manufacturing plants to multiple other countries. Fluctuations of exchange

rates may adversely affect the performance and nancial conditions of The Group as well as our competitiveness.

Further, the exchange uctuations will affect the price setting of the products sold by The Company in foreign currencies as well

as the price of the raw materials purchased. The ratio of the overseas sales has reached 60 percent of consolidated sales for the

current consolidated scal year, and transactions in foreign currencies account for signicant part. We take hedging measures

such as forward exchange contracts to reduce the risks of exchange-rates and interest-rates uctuations, but it is impossible to

hedge every risk, and the yen appreciation against other currencies may adversely affect the performance and nancial condi-

tions of The Group. On the contrary, the yen depreciation may result in opportunity losses.

(5) Government regulations

Various legal regulations are applied to the motorcycle, automobile and outboard motor industries in relation to the emission level

of emission gas, mileage, noises, safety and contaminated material emission level from the manufacturing plants. These regu-

lations may be revised, in many cases strengthened. Expenses to comply with these regulations may largely affect the perfor-

mance of The Group.

In addition, many governments determine the imposition of tariffs, price control regulations and exchange control regulations.

The Group is paying expenses to comply with these regulations and will expect to continue bearing them. We may pay more

expenses depending on the establishment of new laws or changes of existing laws. Further, unexpected changes or new appli-

cation of tax systems and economic measures of each country may adversely affect the performance and nancial conditions of

The Group.

(6) Quality assurance

We place the top priority on the product safety and make efforts to establish the quality assurance system from develop-

ment to sales. We buy insurance for the product liability, but there are risks not covered by insurance. The occurrence of

large expenses for a large-scale recall to ensure safety of the customers may adversely affect the performance and nan-

cial conditions of The Group.

(7)Alliancewithothercompanies

We conduct various alliance activities with automobile manufacturer around the world and other companies for research and

development, manufacturing, sales and nance, but factors that can not be controlled by The Group such as situations inherent

to the alliance partners may adversely affect the performance and nancial conditions of The Group.

(8)Legalproceedings

We may become a party to lawsuits and other legal proceedings in the course of our business activities. In the case where any

judgments disadvantageous to us are made in such legal proceedings, they may adversely affect the performance and nancial

conditions of The Group.

(9)Inuencesofnaturaldisasters,wars,terrorismandstrikes,etc.

The major manufacturing plants of The Group in Japan conduct manufacturing activities, located mainly in the Tokai region. In

addition, the head ofce and other facilities of The Company are also concentrated in the Tokai region. Any occurrences of Tokai

and Tonankai earthquake may largely affect adversely the performance and nancial condition of The Group. We have taken

various preventive measures such as quake-resistant measures for buildings and facilities, re preventive measures, establish-

ment of business recovery plans, purchases of earthquake insurances to minimize the inuences of damage by such disasters.

We also conduct businesses around the world and are subject to number of risks relating to our overseas operations. Such risks

include political or social instability and difculties, natural disasters, diseases, wars, terrorism and strikes. These unexpected

events may delay or suspend the purchase of raw materials and parts, manufacturing, sales of products, logistics and provision

of services. If such delay or suspension caused by any of these factors occur or prolong, they may adversely affect the perfor-

mance and nancial conditions of The Group.

Further, there are various risks other than those mentioned above, and what have been stated in this section do not represent all

the risks of The Group.