Suzuki 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

Notes to Consolidated Financial Statements

NOTE 1:Basisofpresentingconsolidatednancialstatements

The accompanying consolidated nancial statements of Suzuki Motor Corporation (The Company) have been prepared on the

basis of generally accepted accounting principles and practices in Japan, and the consolidated nancial statements were led

with the Financial Services Agency as required by the Financial Instruments and Exchange Act of Japan.

The preparation of the consolidated nancial statements requires the management to select and adopt accounting standards and

make estimates and assumptions that affect the reported amount of assets and liabilities, revenue and expenses, and the cor-

responding methods of disclosure.

As such, the management’s estimates are made reasonably based on historical results. But due to the inherent uncertainty in-

volved in making estimates, actual results could differ from these estimates.

For the convenience of readers outside Japan, certain reclassications and modications have been made to the original consoli-

dated nancial statements.

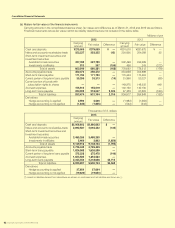

As permitted, an amount of less than one million yen has been omitted. For the convenience of readers, the consolidated nan-

cial statements, including the opening balance of shareholders’ equity, have been presented in U.S. dollars by translating all

Japanese yen amounts on the basis of 94.05 to U.S. $1, the rate of exchange prevailing as of March 29, 2013. Consequently, the

totals shown in the consolidated nancial statements (both in yen and in U.S. dollars) do not necessarily agree with the sum of the

individual amounts.

NOTE 2:Summaryofsignicantaccountingpolicies

(a) Principles of consolidation

The consolidated nancial statements for the years ended March 31, 2013 and 2012, include the accounts of The Company

and its signicant subsidiaries and the number of consolidated subsidiaries are 135 and 138 respectively. All signicant inter-

company accounts and transactions are eliminated in consolidation. Investments in afliated companies are accounted for by

the equity method.

The difference at the time of acquisition between the cost and underlying net equity of investments in consolidated subsidiar-

ies (goodwill) and in afliated companies accounted for under the equity method is, as a rule, amortized on a straight-line

basis over a period of ve years after appropriate adjustments.

The account settlement date of 30 consolidated subsidiaries is December 31, but Magyar Suzuki Corporation Ltd. and 4 oth-

ers are consolidated based on the nancial statements of provisional account settlement as of March 31. Other 25 subsidiar-

ies are consolidated with the nancial statements based on their respective account settlement date.

The account settlement date of other consolidated subsidiaries is the same as the consolidated account settlement date.

(b) Allowance for doubtful accounts

In order to allow for loss from bad debts, estimated uncollectible amount based on actual ratio of bad debt is appropriated as

to general receivable. As for specic receivable with higher default possibility, possibility of collection is estimated respectively

and uncollectible amount is appropriated.

(c) Provision for product warranties

The provision is appropriated into this account based on the warranty agreement and past experience in order to allow for

expenses related to the maintenance service of products sold.

(d) Provision for recycling expenses

The provision is appropriated for an estimated expense related to the recycle of products of The Company based on

actual sales.

(e) Provision for product liabilities

With regards to the products exported to North American market, to prepare for the payment of compensation, not covered by

“Product Liability Insurance” the anticipated amount to be borne by The Company is computed and provided on the basis of

actual results in the past.

(f) Short-term investment securities and Investment securities

The Company and its subsidiaries hold securities of listed companies, which have a risk of price uctuations, and non-listed

companies whose stock prices are difcult to be evaluated.

If we judge the decline in investment value is not temporary, we recognize revaluation loss based on the reasonable standard.

If the stock market falls, we may incur signicant loss on valuation of securities.

Securities have to be classied into four categories: trading securities; held-to-maturity debt securities; investments of The

Company in equity securities issued by consolidated subsidiaries and afliates; and available-for-sale securities.

According to this classication, securities held by The Company and its subsidiaries are available-for-sale securities. Avail-

able-for-sale securities for which market quotations are available are stated at market value method based on the market

values as of the consolidated account settlement date (The evaluation differences shall be reported as a component of net as-

sets, and sales costs shall be calculated mainly by the moving average method).

Available-for-sale securities for which market quotations are unavailable are stated at cost by a moving average method.