Suzuki 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 9

Year in Review

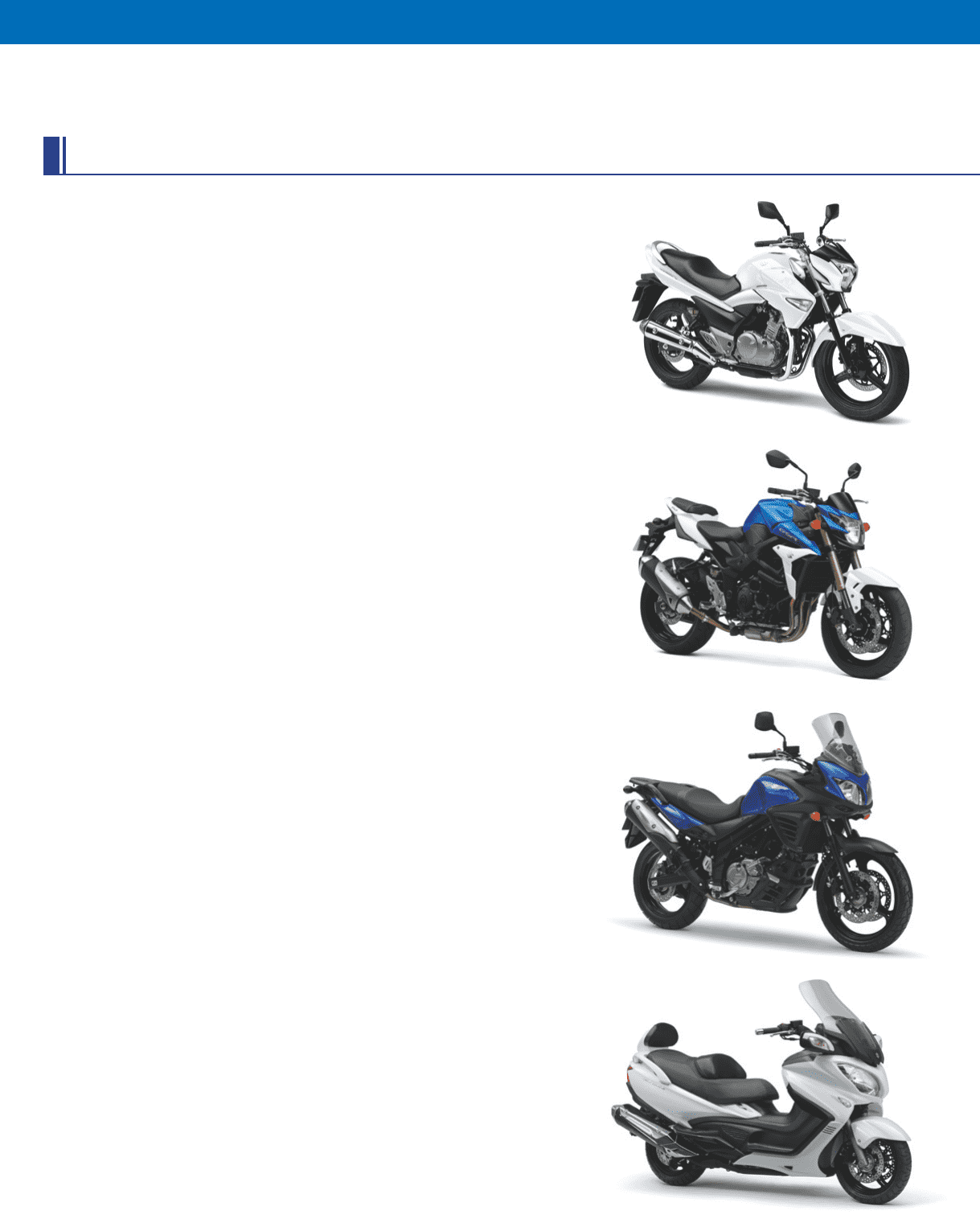

GSR250

GSR750ABS

V-Strom 650 ABS

SKYWAVE650LX

Motorcycles

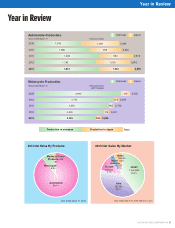

Suzuki’s Worldwide Manufacturing and Sales

Total overseas motorcycle production (including ATVs) in scal 2012 decreased to 2,100,000

units, 87.5% compared to the previous scal year. Worldwide production, including production in

Japan, also decreased to 2,269,000 units, 88.1% compared to the previous scal year.

Sales of motorcycle (including ATVs) in overseas market decreased to 2,236,000 units,

89.1% compared to the previous scal year, while total global sales, including Japan,

also decreased to 2,312,000 units, 89.3% compared to the previous scal year.

Operating Results by Segment

In the motorcycle business, there was operating loss of ¥11.9 billion due to decrease

of sales in Europe and Asia. Although the situation continues to be grim in terms of the

income, the Company will continue with its R&D as well as facility investments in mar-

kets such as India and ASEAN by standing in the medium term viewpoint.

The Japanese Market

1. Overview of Japanese Motorcycle Market

The total domestic motorcycle sales (factory shipments) of the four Japanese manufac-

turers in scal 2012 were roughly at on the year, declining by 1% to 402,000 units. De-

mand for models with engine displacements up to 125cm3 declined; sales were down

5% year-on-year at 335,000 units. Demand for models with engine displacements of

126cm3 and higher increased; sales grew by 23% year-on-year to 68,000 units.

2. Suzuki Sales

Suzuki saw an increase in its sales (factory shipments) of models with engine displace-

ments of 126cm3 and higher. It saw a decrease in its sales of models with engine dis-

placements up to 125cm3. The Company’s total sales declined by 3% year-on-year to

72,600 units. Sales of models with engine displacements up to 50cm3 fell by 9% year-on-

year to 46,500 units. Sales of models with engine displacements from 51cm3 to 125cm3

were at on the year at 16,500 units. Combined sales of models with engine displace-

ments up to 125cm3 were down 7% year-on-year at 63,000 units. Sales of models with

engine displacements from 126cm3 to 250cm3 grew by 45% year-on-year to 6,800 units.

Sales of models with engine displacements of 251cm3 and higher grew by 1% year-on-

year to 2,700 units. Combined sales of models with engine displacements of 126cm3 and

higher grew by 29% year-on-year to 9,600 units.

3. Suzuki Topics in Fiscal 2012

• Demand in Japan for models with engine displacements up to 125cm3 is trending

downward. At the same time, demand for models with engine displacements of

126cm3

and higher

is trending upward. Suzuki launched the GSR250 (a totally new

model made in China) in Japan in July 2012. A surge in purchases by young custom-

ers who were new to motorcycling supported strong growth in sales of models with

engine displacements from 126cm3 to 250cm3.

• Suzuki began devoting greater eort to boosting its sales of models with engine dis-

placements of 126cm3

and higher

. Such models are highly profitable. Suzuki

launched the V-Strom 650 ABS (a totally new model) in December 2012; the new

Skywave650LX (the result of a model change) in January 2013; and the GSR750 (a

totally new model) in March 2013.