Supercuts 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

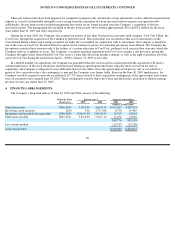

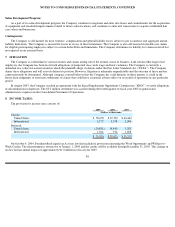

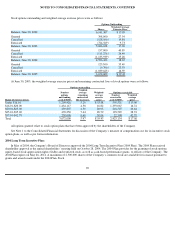

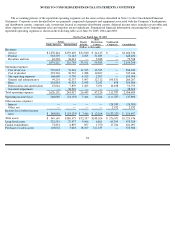

Stock options outstanding and weighted average exercise prices were as follows:

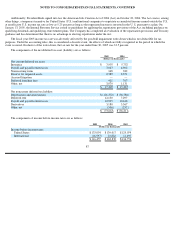

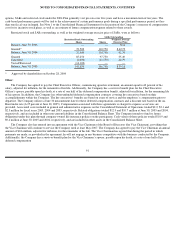

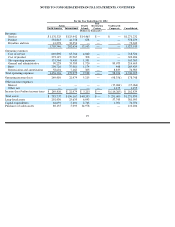

At June 30, 2005, the weighted average exercise prices and remaining contractual lives of stock options were as follows:

All options granted relate to stock option plans that have been approved by the shareholders of the Company.

See Note 1 to the Consolidated Financial Statements for discussion of the Company’

s measure of compensation cost for its incentive stock

option plans, as well as pro forma information.

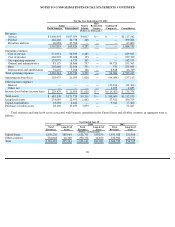

2004 Long Term Incentive Plan:

In May of 2004, the Company’s Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received

shareholder approval at the annual shareholders’ meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock options,

equity-based stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to officers of the Company. The

2004 Plan expires on May 26, 2014. A maximum of 2,500,000 shares of the Company’s common stock are available for issuance pursuant to

grants and awards made under the 2004 Plan. Stock

90

Options Outstanding

Weighted Average

Shares

Exercise Price

Balance, June 30, 2002

6,141,307

$

15.85

Granted

398,000

27.54

Cancelled

(128,100

)

19.84

Exercised

(724,569

)

9.73

Balance, June 30, 2003

5,686,638

17.30

Granted

157,000

40.89

Cancelled

(111,276

)

24.49

Exercised

(1,135,939

)

15.28

Balance, June 30, 2004

4,596,423

18.32

Granted

125,500

35.49

Cancelled

(9,700

)

23.53

Exercised

(1,039,623

)

16.59

Balance, June 30, 2005

3,672,600

$

19.43

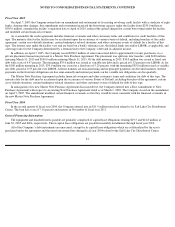

Options outstanding

Number

Weighted

average

Weighted

-

Options exercisable

Range of exercise prices

options

outstanding

as of 6/30/05

remaining

contractual

life (in years)

average

exercise

price

Number

exercisable

as of 6/30/05

Weighted

average

price

Under $16.01

1,290,426

5.20

$

15.08

595,531

$

15.00

$16.01

-

$20.00

1,434,117

4.58

16.82

1,393,067

16.74

$20.01

-

$25.00

239,807

4.50

20.93

218,507

20.64

$25.01

-

$35.00

470,250

7.44

28.79

193,529

28.74

$35.01-$42.79

238,000

9.40

38.94

22,500

42.79

Total

3,672,600

5.47

$

19.43

2,423,134

$

17.86