Supercuts 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

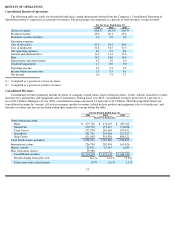

The increase in interest expense as a percent of total revenues during the year ended June 30, 2005 was primarily due to an increase in our

debt level stemming from fiscal year 2005 acquisition activity, including the hair restoration centers and additional beauty schools. The fiscal

year 2004 decrease in interest, and improvement as a percent of total consolidated revenues, stemmed from our strong cash flow and lower

outstanding debt balance as a result of the timing of acquisitions. In addition, the expiration of $55.0 million of pay-fixed, receive-variable

interest rate swaps in the fourth quarter of fiscal year 2003 contributed to the improvement, as a larger percentage of our total debt was subject

to lower short-term variable interest rates.

Income Taxes

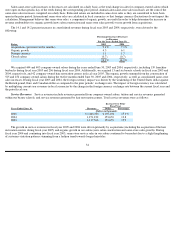

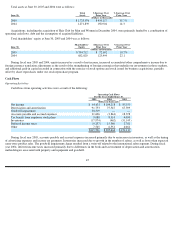

Our reported effective tax rate was as follows:

The increase in our overall effective tax rate for the years ended June 30, 2005 was solely related to the goodwill impairment charge in the

international salon segment, which is non-deductible for tax purposes. Excluding the impact of the goodwill impairment charge, our effective

tax rate improved by 250 basis points during fiscal year 2005, primarily due to the successful settlement of our federal audit and the reinstated

Work Opportunity Credit during fiscal year 2005 (see Note 8 to the Consolidated Financial Statements). The improvement in our fiscal year

2004 overall effective tax rate was also due to a larger percentage of our income being generated in lower rate international tax jurisdictions.

Recent Accounting Pronouncements

Recent accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements.

Effects of Inflation

We compensate some of our salon employees with percentage commissions based on sales they generate, thereby enabling salon payroll

expense as a percent of company-owned salon revenues to remain relatively constant. Accordingly, this provides us certain protection against

inflationary increases, as payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may

increase pricing in our salons to offset any significant increases in wages. Nevertheless, we estimate that we must achieve an annual same-

store

sales increase in excess of two percent to offset the impact of inflationary pressures on fixed costs, such as rent, site operating expenses and

general and administrative expenses in order to achieve our long-term earning objectives.

39

Effective

Basis Point (Increase)

Years Ended June 30,

Rate

Improvement

2005

44.5

%

(850

)

2004

36.0

140

2003

37.4

30