Supercuts 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

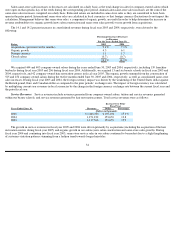

Organic salon revenue growth is achieved through the combination of new salon construction and salon same-store sales increases. Each

fiscal year, we anticipate building several hundred corporate salons. We anticipate our franchisees will open several hundred salons as well.

Older, unprofitable salons will be closed or relocated. Our long-term outlook for our salon business is for annual consolidated low single-digit

same-store sales increases. Based on current fashion and economic cycles (e.g., longer hairstyles and lengthening of customer visitation

patterns), we project our annual fiscal year 2006 consolidated same-store sales increase to be below the low end of our long-term outlook

range.

Historically, our salon acquisitions have varied in size from as small as one salon to over one-thousand salons. The median acquisition

size is approximately ten salons. From fiscal year 1994 to fiscal year 2005, we completed 339 acquisitions, adding a net of 7,165 salons. We

anticipate adding several hundred corporate salons each year from acquisitions. Some of these acquisitions may include buying salons from our

franchisees.

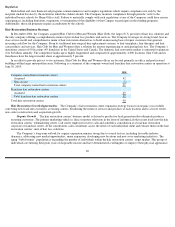

Hair Restoration Business

In December 2004, we acquired Hair Club for Men and Women. Hair Club for Men and Women is the industry leading provider of hair

loss solutions with an estimated five percent share of the $4 billion domestic market. This industry is comprised of approximately 4,000

locations domestically and is highly fragmented. As a result, we believe there is an opportunity to consolidate this industry through acquisition.

Expanding the hair loss business organically and through acquisition would allow us to add incremental revenue which is neither dependent

upon, nor dilutive to, our existing salon and school businesses.

Our organic growth plans for hair restoration include the construction of a modest number of new locations in untapped markets

domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for

salon expansion. In an effort to provide confidentiality for their customers, hair restoration centers operate primarily in professional or medical

office buildings. Further, the hair restoration business is more marketing intensive. As a result, organic growth at our hair restoration centers

will be dependent on successfully generating new leads and converting them into hair restoration customers. Our growth expectations for our

hair restoration business are not dependent on referral business from, or cross-marketing with, our hair salon business, but will be evaluated

closely for additional growth opportunities.

Beauty School Business

We have begun acquiring and are exploring the possibility of building beauty schools. The beauty school business is highly profitable, and

often participates in governmental programs designed to encourage education. We believe there is an opportunity to place graduates in our

various salon concepts which may provide us with another competitive advantage. Similar to the salon and hair loss industries, the beauty

school industry is highly fragmented. As a result, we believe there is an opportunity to consolidate this industry through acquisition, as well.

Expanding this business would allow us to add incremental revenue without cannibalizing our existing salon or hair restoration center

businesses. Primarily through acquisition, we believe beauty schools could contribute over $100 million in annual revenue within a few years.

Our organic growth plans for the beauty school business include the construction of new locations; however, due to U.S. Department of

Education policies, we will be limited in the number of new schools we are able to construct in the immediate future. The success of a beauty

school location is not dependent on good visibility or strong customer traffic; however, access to parking and/or public transportation is

important. The success of existing and newly constructed schools is dependent on effective marketing and recruiting to attract new enrollees.

For a discussion of our near-term expectations, please refer to the Investor Information section of our website at www.regiscorp.com .

29