Supercuts 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

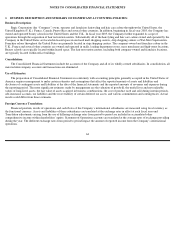

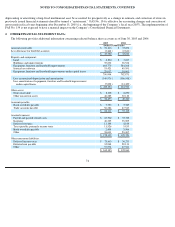

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Business Description:

Regis Corporation (the “Company”) owns, operates and franchises hairstyling and hair care salons throughout the United States, the

United Kingdom (U.K.), France, Canada, Puerto Rico and several other countries. In addition, beginning in fiscal year 2003, the Company has

owned and operated beauty schools in the United States and the U.K.. In fiscal year 2005, the Company further expanded its scope of

operations through the acquisition of hair restoration centers. Substantially all of the hairstyling and hair care salons owned and operated by the

Company in the United States are located in leased space in enclosed mall shopping centers, strip shopping centers or Wal-Mart Supercenters.

Franchise salons throughout the United States are primarily located in strip shopping centers. The company-owned and franchise salons in the

U.K., France and several other countries are owned and operated in malls, leading department stores, mass merchants and high-street locations.

Beauty schools are typically located within leased space. The hair restoration centers, including both company-owned and franchise locations,

are typically located within office buildings.

Consolidation:

The Consolidated Financial Statements include the accounts of the Company and all of its wholly-

owned subsidiaries. In consolidation, all

material intercompany accounts and transactions are eliminated.

Use of Estimates:

The preparation of Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of

America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. The more significant estimates made by management are the valuation of goodwill, the useful lives and net realizable

values of long-lived assets, the fair value of assets acquired in business combinations, the cost of product used and sold during interim periods,

self-insurance accruals, tax liabilities and the recoverability of certain deferred tax assets, and various commitments and contingencies. Actual

results could differ from those estimates.

Foreign Currency Translation:

Financial position, results of operations and cash flows of the Company’s international subsidiaries are measured using local currency as

the functional currency. Assets and liabilities of these subsidiaries are translated at the exchange rates in effect at each fiscal year end.

Translation adjustments arising from the use of differing exchange rates from period to period are included in accumulated other

comprehensive income within shareholders’

equity. Statement of Operations accounts are translated at the average rates of exchange prevailing

during the year. The different exchange rates from period to period impact the amount of reported income from the Company’s international

operations.

64