Supercuts 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

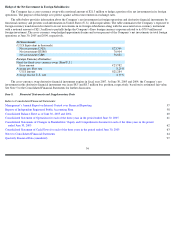

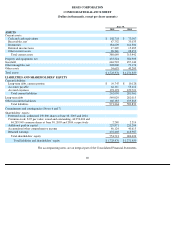

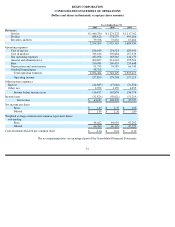

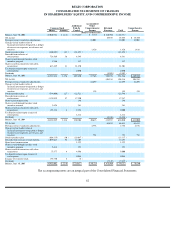

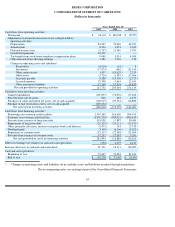

REGIS CORPORATION

CONSOLIDATED STATEMENT OF CASH FLOWS

(Dollars in thousands)

*

Changes in operating assets and liabilities do not include assets and liabilities assumed through acquisitions

The accompanying notes are an integral part of the Consolidated Financial Statements.

63

Years Ended June 30,

2005

2004

2003

Cash flows from operating activities:

Net income

$

64,631

$

104,218

$

85,555

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation

83,527

72,096

63,767

Amortization

8,226

3,451

3,632

Deferred income taxes

(9,257

)

15,340

2,781

Goodwill impairment

38,319

—

—

Tax benefit from stock

-

based employee compensation plans

9,088

8,314

4,090

Other noncash items affecting earnings

1,181

1,265

710

Changes in operating assets and liabilities*:

Receivables

(6,516

)

(16

)

8

Inventories

(17,974

)

(462

)

(31,145

)

Other current assets

1,437

(10,629

)

2,120

Other assets

(5,726

)

(1,387

)

(13,606

)

Accounts payable

8,288

(13,305

)

(2,727

)

Accrued expenses

23,338

9,461

21,105

Other noncurrent liabilities

17,169

17,318

14,829

Net cash provided by operating activities

215,731

205,664

151,119

Cash flows from investing activities:

Capital expenditures

(101,097

)

(74,076

)

(77,460

)

Proceeds from sale of assets

846

432

1,273

Purchases of salon and school net assets, net of cash acquired

(118,915

)

(99,734

)

(66,880

)

Purchase of hair restoration centers, net of cash acquired

(209,652

)

—

—

Net cash used in investing activities

(428,818

)

(173,378

)

(143,067

)

Cash flows from financing activities:

Borrowings on revolving credit facilities

2,954,100

514,650

854,195

Payments on revolving credit facilities

(2,976,750

)

(508,025

)

(886,420

)

Proceeds from issuance of long

-

term debt

301,938

11,887

30,000

Repayments of long

-

term debt

(21,313

)

(24,111

)

(11,471

)

Other, primarily (decrease) increase in negative book cash balances

(2,472

)

118

(2,720

)

Dividends paid

(7,149

)

(6,166

)

(5,202

)

Repurchase of common stock

(23,117

)

(22,548

)

(21,694

)

Proceeds from issuance of common stock

17,257

17,347

7,051

Net cash provided by (used in) financing activities

242,494

(16,848

)

(36,261

)

Effect of exchange rate changes on cash and cash equivalents

(256

)

2,675

2,122

Increase (decrease) in cash and cash equivalents

29,151

18,113

(26,087

)

Cash and cash equivalents:

Beginning of year

73,567

55,454

81,541

End of year

$

102,718

$

73,567

$

55,454