Supercuts 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

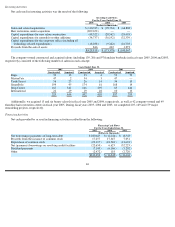

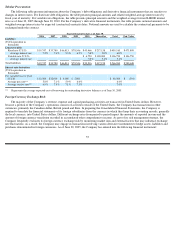

Hedge of the Net Investment in Foreign Subsidiaries:

The Company has a cross-currency swap with a notional amount of $21.3 million to hedge a portion of its net investments in its foreign

operations. The purpose of this hedge is to protect against adverse movements in exchange rates.

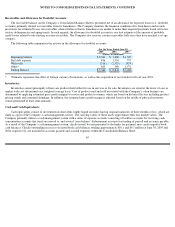

The table below provides information about the Company’s net investments in foreign operations and derivative financial instruments by

functional currency and presents such information in United States (U.S.) dollar equivalents. The table summarizes the Company’s exposure to

foreign currency translation risk related to its net investments in its foreign subsidiaries along with the associated cross-currency instrument

with a notional amount of $21.3 million to partially hedge the Company’s Euro foreign currency exposure related to its $70.9 million net

foreign investment. The cross-currency swap hedged approximately nine and seven percent of the Company’s net investments in total foreign

operations at June 30, 2005 and 2004, respectively.

The cross-currency swap derivative financial instrument expires in fiscal year 2007. At June 30, 2005 and 2004, the Company’s net

investment in this derivative financial instrument was in an $8.5 and $8.7 million loss position, respectively, based on its estimated fair value.

See Note 5 to the Consolidated Financial Statements for further discussion.

Item 8.

Financial Statements and Supplementary Data

56

Net Investments:

(U.S.$ Equivalent in thousands)

Net investment (CND)

$73,799

Net investment (EURO)

70,904

Net investment (GBP)

56,832

Foreign Currency Derivative:

Fixed

-

for

-

fixed cross currency swap (Euro/U.S.)

Euro amount

€

23,782

Average pay Euro rate

8.29

%

U.S.$ amount

$21,284

Average receive U.S. rate

8.39

%

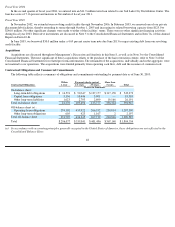

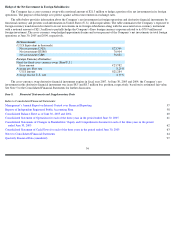

Index to Consolidated Financial Statements:

Management

’

s Annual Report on Internal Control over Financial Reporting

57

Reports of Independent Registered Public Accounting Firm

58

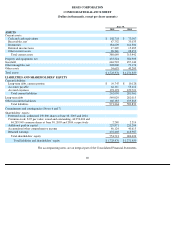

Consolidated Balance Sheet as of June 30, 2005 and 2004

60

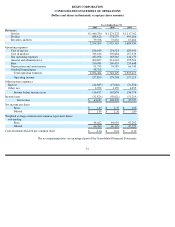

Consolidated Statement of Operations for each of the three years in the period ended June 30, 2005

61

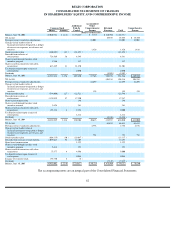

Consolidated Statements of Changes in Shareholders’ Equity and Comprehensive Income for each of the three years in the period

ended June 30, 2005

62

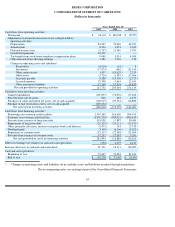

Consolidated Statement of Cash Flows for each of the three years in the period ended June 30, 2005

63

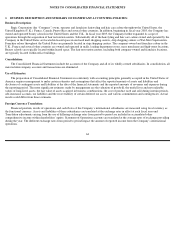

Notes to Consolidated Financial Statements

64

Quarterly Financial Data (unaudited)

97