Supercuts 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

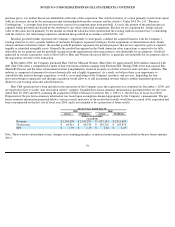

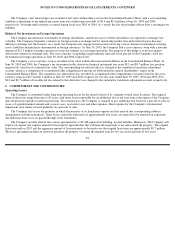

Refer to the discussion related to the acquisition of Hair Club for Men and Women below.

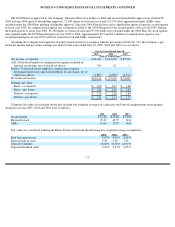

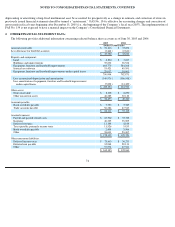

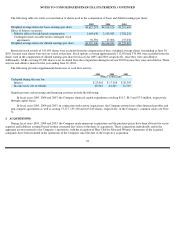

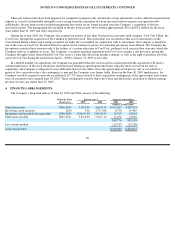

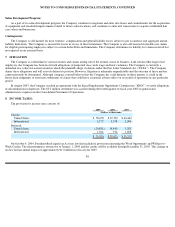

The value and related weighted average amortization periods for the intangibles acquired during fiscal year 2005 business acquisitions, in

total and by major intangible asset class, are as follows

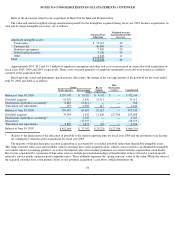

Approximately $0.8, $0.1 and $1.1 million of employee termination and other exit costs were incurred in connection with acquisitions in

fiscal years 2005, 2004 and 2003, respectively. These costs consisted primarily of employee termination costs and were treated as a liability

assumed at the acquisition date.

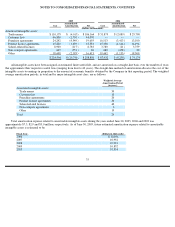

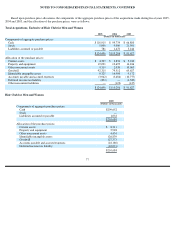

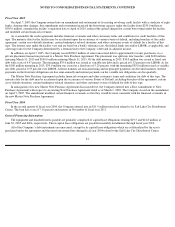

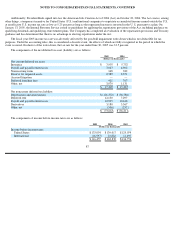

Based upon the actual and preliminary purchase price allocations, the change in the carrying amount of the goodwill for the years ended

June 30, 2005 and 2004 is as follows:

*

Relates to the finalization of the allocation of goodwill to the related reporting units for fiscal year 2004 and the resolution of an income

tax contingency related to prior acquisitions for fiscal year 2005.

The majority of the purchase price in salon acquisitions is accounted for as residual goodwill rather than identifiable intangible assets.

This stems from the value associated with the walk-in customer base of the acquired salons, which is not recorded as an identifiable intangible

asset under current accounting guidance, as well as the limited value and customer preference associated with the acquired hair salon brand.

Key factors considered by consumers of hair salon services include personal relationships with individual stylists (driven by word-of-mouth

referrals), service quality and price point competitiveness. These attributes represent the “going concern” value of the salon. While the value of

the acquired customer base is the primary driver of any potential acquisition’s cash flows (which determines the

78

Weighted Average

Purchase Price

Amortization Period

Allocation

(in years)

Amortized intangible assets:

Trade names

$

72,611

40

Customer list

46,800

10

Franchise agreements

7,505

20

School

-

related licenses

5,120

40

Other

4,128

11

Total

$

136,164

28

Salons

Beauty

Hair

Restoration

North America

International

Schools

Centers

Consolidated

(Dollars in thousands)

Balance at June 30, 2003

$

297,943

$

70,523

$

4,152

$

—

$

372,618

Goodwill acquired

63,329

2,470

13,713

—

79,512

Finalization of purchase accounting*

8,882

(8,314

)

—

—

568

Translation rate adjustments

193

4,002

247

—

4,442

Balance at June 30, 2004

370,347

68,681

18,112

—

457,140

Goodwill acquired

79,544

1,432

11,206

127,506

219,688

Finalization of purchase accounting*

—

3,767

—

—

3,767

Impairment

—

(

38,319

)

—

—

(

38,319

)

Translation rate adjustments

2,805

1,471

(42

)

—

4,234

Balance at June 30, 2005

$

452,696

$

37,032

$

29,276

$

127,506

$

646,510