Supercuts 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

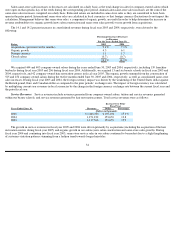

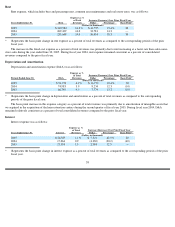

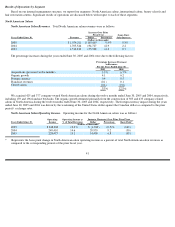

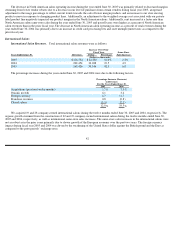

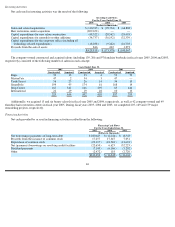

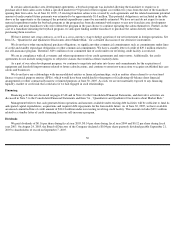

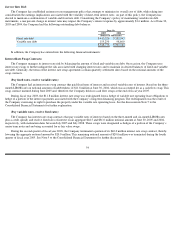

Beauty School Operating Income. Operating income for our beauty schools was as follows:

(a)

We did not own or operate any beauty schools until December of 2002 (i.e., the second quarter of fiscal year 2003).

*

Represents the basis point change in beauty school operating income as a percent of total beauty school revenues as compared to the

corresponding periods of the prior fiscal year.

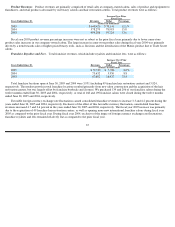

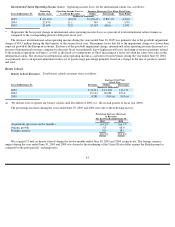

We first began operating beauty schools during December 2002 (i.e., the second quarter of fiscal year 2003), in conjunction with the Vidal

Sassoon acquisition. We have since expanded by acquiring six beauty schools during fiscal year 2004, and 13 additional schools during fiscal

year 2005. Therefore, the year

-over-year fluctuations in beauty school operating income stem primarily from our integration of the new beauty

schools and changes in the mix of beauty schools due to these acquisitions.

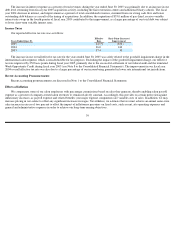

Hair Restoration Centers

As discussed in Note 3 to the Consolidated Financial Statements, we acquired Hair Club for Men and Women in December 2004.

Therefore, our operating results for the year ended June 30, 2005 include only seven months of operations from this acquired entity (referred to

as hair restoration centers for segment reporting purposes). Refer to Note 11 of the Consolidated Financial Statements for the results of

operations related to the hair restoration centers which were included in our Consolidated Statement of Operations and Note 3 for related pro

forma information.

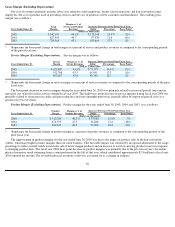

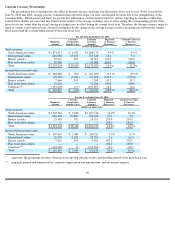

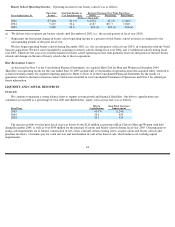

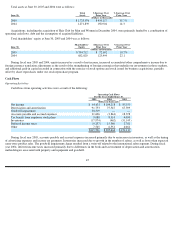

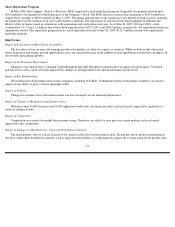

LIQUIDITY AND CAPITAL RESOURCES

Overview

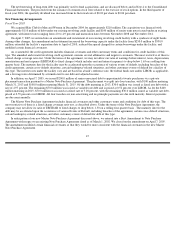

We continue to maintain a strong balance sheet to support system growth and financial flexibility. Our debt to capitalization ratio,

calculated as total debt as a percentage of total debt and shareholders’ equity at fiscal year end, was as follows:

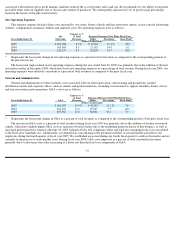

The increase in debt over the prior fiscal year was driven by the $210 million acquisition of Hair Club for Men and Women with debt

during December 2004, as well as over $100 million for the purchase of salons and beauty schools during fiscal year 2005. Our principal on-

going cash requirements are to finance construction of new stores, remodel certain existing stores, acquire salons and beauty schools and

purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital

requirements.

44

Operating

Operating Income as

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Income

% of Total Revenues

Dollar

Percentage

Basis Point*

(Dollars in thousands)

2005

$

7,466

22.0

%

$

2,251

43.2

%

(1,240

)

2004

5,215

34.4

4,187

407.3

1,040

2003

1,028

24.0

N/A

(a)

N/A

(a)

N/A

(a)

Debt to

Basis Point (Increase)

Fiscal Year

Capitalization

Improvement

2005

43.0

%

(1,240

)

2004

30.6

450

2003

35.1

530