Supercuts 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

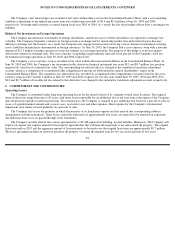

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

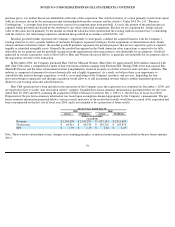

The debt agreements contain covenants, including limitations on incurrence of debt, granting of liens, investments, merger or

consolidation, and transactions with affiliates. In addition, the Company must adhere to specified fixed charge coverage and leverage ratios, as

well as minimum net worth levels.

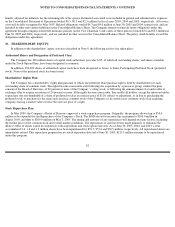

As a result of the fair value hedging activities discussed in Note 5, an adjustment of approximately $2.5 and $3.5 million was made to

increase the carrying value of the Company’s long-term fixed rate debt at June 30, 2005 and 2004, respectively. Therefore, at June 30, 2005

and 2004, approximately 12 and 30 percent of the Company’s fixed rate debt has been marked to market, respectively.

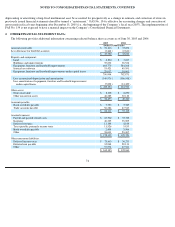

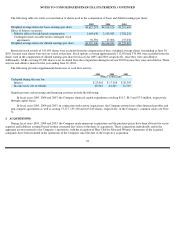

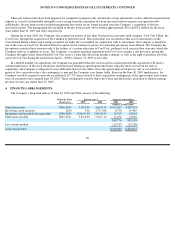

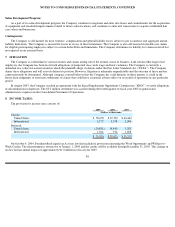

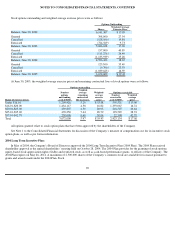

Aggregate maturities of long-term debt, including associated fair value hedge obligations of $2.5 million and capital lease obligations of

$19.5 million at June 30, 2005, are as follows:

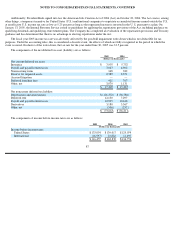

5. DERIVATIVE FINANCIAL INSTRUMENTS:

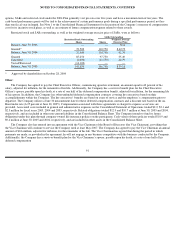

The primary market risk exposure of the Company relates to changes in interest rates in connection with its debt, some of which bears

interest at variable rates based on LIBOR plus an applicable borrowing margin. Additionally, the Company is exposed to foreign currency

translation risk related to its net investments in its foreign subsidiaries. The Company has established policies and procedures that govern the

management of these exposures through the use of derivative financial instrument contracts. By policy, the Company does not enter into such

contracts for the purpose of speculation.

The Company has established an interest rate management policy that attempts to minimize its overall cost of debt, while taking into

consideration the earnings implications associated with the volatility of short-term interest rates. As part of this policy, the Company has

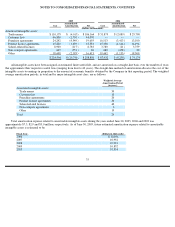

elected to maintain a combination of variable and fixed rate debt. As of June 30, 2005 and 2004, the Company had the following outstanding

debt balances:

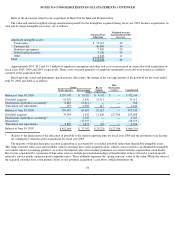

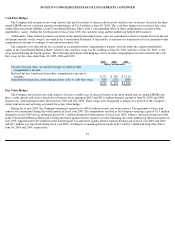

Considering the Company’s policy of maintaining variable rate debt instruments, a one percent change in interest rates (including the

impact of existing interest rate swap contracts) may impact the Company’s interest expense by approximately $1.6 million. To reduce the

volatility associated with interest rate movements, the Company has entered into the following financial instruments:

82

Fiscal year

(Dollars in thousands)

2006

$

19,747

2007

33,980

2008

66,813

2009

80,862

2010

50,216

Thereafter

317,158

$

568,776

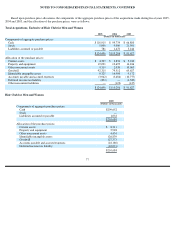

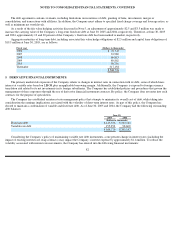

June 30,

2005

2004

(Dollars in thousands)

Fixed rate debt

$

413,526

$

202,543

Variable rate debt

155,250

98,600

$

568,776

$

301,143