Supercuts 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and anticipating industry trends for purposes of pricing and staffing. The Company has expanded the corporate information systems to deliver

on-line information of product sales to improve its inventory control system, including monthly replenishment recommendations for a salon.

Management believes that its information systems provide advantages in planning and analysis which are generally not available to a majority

of its competitors.

Salon Competition:

The hair care industry is highly fragmented and competitive. In every area in which the Company has a salon, there are competitors

offering similar hair care services and products at similar prices. The Company faces competition within malls from companies which operate

salons within department stores and from smaller chains of salons, independently owned salons and, to a lesser extent, salons which, although

independently owned, are operating under franchises from a franchising company that may assist such salons in areas of training, marketing

and advertising.

Significant entry barriers exist for chains to expand nationally due to the need to establish systems and infrastructure, recruitment of

experienced hair care management and adequate store staff, and leasing of quality sites. The principal factors of competition in the affordable

hair care category are quality, consistency and convenience. The Company continually strives to improve its performance in each of these areas

and to create additional points of difference versus the competition. In order to obtain locations in shopping malls, the Company must be

competitive as to rentals and other customary tenant obligations.

Beauty School Business Strategy:

The Company is currently pursuing acquisitions of beauty schools in North America. Operating beauty schools is complementary to the

salon business as it allows the Company to attract, train and retain valuable employees. The Company expects to open and acquire additional

beauty schools in the future in order to take advantage of this opportunity. The principle activity of the beauty schools is the teaching of

beauticians to prepare for their licensing. The activities also include clinic and school sales of products to students and customers and other

miscellaneous sales. Subjects available for enrollment include cosmetology, nail art and esthetic programs. Most schools are certified by the

U.S. Department of Education (ED) for participation in Federal Title IV Student Financial Assistance Programs. As of June 30, 2005, the

Company operated 24 such facilities. The for-profit beauty school industry represents approximately 1,000 schools generating an estimated $1

billion annually. Beauty schools are highly profitable and offer predictable cash flows. Given the attractive unit economics and the fact that

Regis Corporation is the largest employer of beauty school graduates, the Company seeks to be the largest operator of beauty schools, primarily

through the acquisition of existing schools.

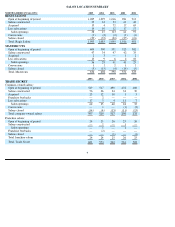

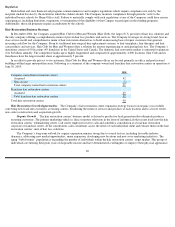

Following is a summary of the Company’s beauty school locations:

Beauty School Growth Opportunities. The Company’s beauty school expansion strategy currently focuses on school acquisitions.

However, the Company plans to supplement acquisition growth with new school construction as permitted by the Department of Education

(ED).

Beauty School Organic Growth . Initially, organic growth from beauty schools will come primarily from increases in enrollment

and tuition increases. Longer-term, organic growth will be supplemented with new school construction.

18

2005

2004

2003

Beauty schools:

Open at beginning of period

11

5

—

Acquired

13

6

5

Total beauty schools

24

11

5