Supercuts 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

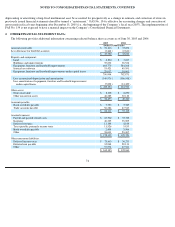

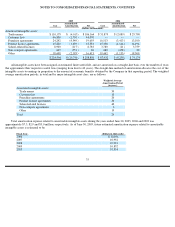

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

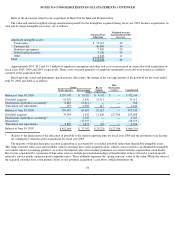

These pro forma results have been prepared for comparative purposes only and include certain adjustments such as additional amortization

expense as a result of identifiable intangible assets arising from the acquisition and from increased interest expense on acquisition debt.

Additionally, the pro forma results include management fees which are no longer incurred since the Company’s acquisition of the hair

restoration centers. The management fees included in the pro forma results above totaled approximately $0.6 and $3.6 million for the fiscal

years ended June 30, 2005 and 2004, respectively.

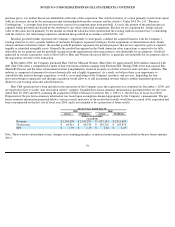

During fiscal year 2005, the Company also acquired an interest of less than 20 percent in a privately held company, Cool Cuts 4 Kids, Inc.

(Cool Cuts), through the acquisition of $4.3 million of preferred stock. This investment was recorded in other assets (noncurrent) on the

Consolidated Balance Sheet and is being accounted for under the cost method. In conjunction with its investment, the Company is entitled to

one of the seats on Cool Cuts’ Board of Directors and received warrants to protect its ownership percentage from dilution. The Company has

the option to exercise these warrants only if the holders of a certain other type of Cool Cuts’ preferred stock exercise their warrants, which the

Company believes is unlikely to occur. The Company’s securities purchase agreement with Cool Cuts contains a call provision, giving the

Company the right of first refusal should Cool Cuts receive a bona fide offer from another company, as well as the right to purchase all of the

assets of Cool Cuts during the period from April 1, 2008 to January 31, 2009 at fair value.

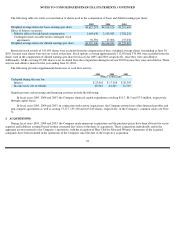

In a limited number of acquisitions, the Company has guaranteed that the stock issued in conjunction with the acquisition will reach a

certain market price. If the stock should not reach this price during an agreed-upon time frame (typically three years from the date of

acquisition), the Company is obligated to issue additional shares to the sellers. Once the agreed-upon stock price is met or exceeded for a

period of five consecutive days, the contingency is met and the Company is no longer liable. Based on the June 30, 2005 market price, the

Company would be required to provide an additional 127,725 shares related to these acquisition contingencies if the agreed-upon time frames

were all assumed to have expired June 30, 2005. These contingently issuable shares have been included in the calculation of diluted earnings

per share for the year ended June 30, 2005.

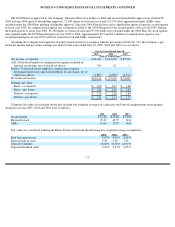

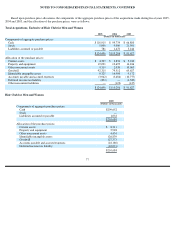

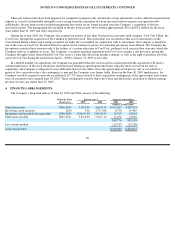

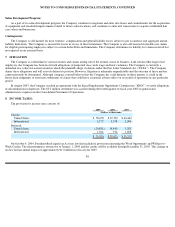

4. FINANCING ARRANGEMENTS:

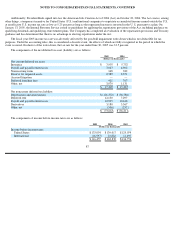

The Company’s long-term debt as of June 30, 2005 and 2004 consists of the following:

80

Maturity Dates

Interest rate %

Amounts outstanding

(fiscal year)

2005

2004

2005

2004

(Dollars in thousands)

Senior term notes

2006

-

2015

3.58

-

8.39

4.69

-

8.39

$

531,015

$

245,891

Revolving credit facilities

2010

5.06

2.73

-

5.06

6,750

29,400

Equipment and leasehold notes payable

2006

-

2010

8.56

-

10.50

5.90

-

10.50

19,515

13,014

Other notes payable

2007

-

2011

5.00

-

8.50

5.00

-

7.16

11,496

12,838

568,776

301,143

Less current portion

(19,747

)

(19,128

)

Long-term portion

$

549,029

$

282,015