Supercuts 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

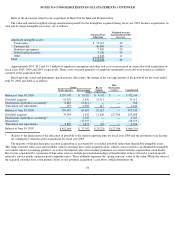

Additionally, President Bush signed into law the American Jobs Creation Act of 2004 (Act) on October 22, 2004. The Act creates, among

other things, a temporary incentive for United States (U.S.) multinational companies to repatriate accumulated income earned outside the U.S.

at an effective U.S. income tax rate as low as 5.25 percent as long as the repatriated income is invested in the U. S. pursuant to a plan. On

January 13, 2005, the Internal Revenue Service issued its guidelines for applying the repatriation provisions of the Act, including guidance on

qualifying dividends and qualifying reinvestment plans. The Company has completed an evaluation of the repatriation provisions and Treasury

guidance and has determined that there is no advantage to electing repatriation under the Act.

The fiscal year 2005 income tax rate was adversely affected by the goodwill impairment write-down which is not deductible for tax

purposes. Under the accounting rules, this is considered a discrete event, the effects of which are fully recognized in the period in which the

event occurred. Exclusive of the write-down, the tax rate for the year ended June 30, 2005 was 33.5 percent.

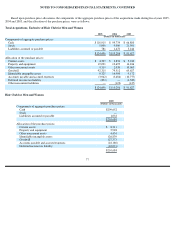

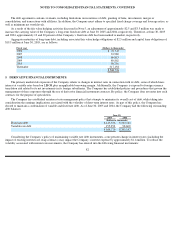

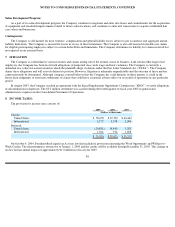

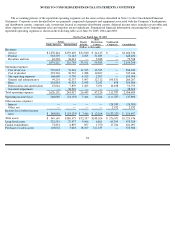

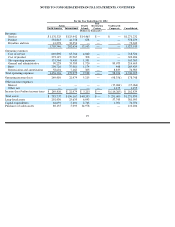

The components of the net deferred tax asset (liability) are as follows:

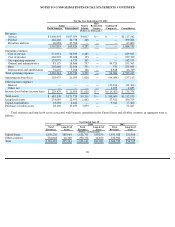

The components of income before income taxes are as follows:

87

2005

2004

(Dollars in thousands)

Net current deferred tax asset:

Insurance

$

3,955

$

5,752

Payroll and payroll related costs

7,027

4,902

Nonrecurring items

368

382

Reserve for impaired assets

2,389

2,351

Accrued litigation

—

—

Deferred franchise fees

411

767

Other, net

3,079

1,131

$

17,229

$

15,285

Net noncurrent deferred tax liability:

Depreciation and amortization

$

(101,372

)

$

(56,786

)

Deferred rent

12,130

7,297

Payroll and payroll related costs

12,905

10,168

Derivatives

3,180

3,367

Other, net

(506

)

(257

)

$

(73,663

)

$

(36,211

)

2005

2004

2003

(Dollars in thousands)

Income before income taxes:

United States

$

133,054

$

139,017

$

125,079

International

(16,597

)

23,822

11,695

$

116,457

$

162,839

$

136,774