Supercuts 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

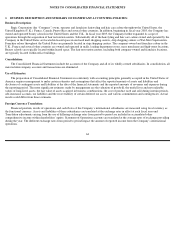

Recent Accounting Pronouncements:

In December 2004, the Financial Accounting Standards Board (FASB) issued a revised FAS No. 123, “Share-Based Payment (revised

2004)” (FAS No. 123R), which supersedes APB No. 25 and amends FAS No. 123 to require companies to expense the value of stock-based

compensation plans. Additionally, FAS 123R, once adopted, disallows the use of the prospective transition method permitted by FAS No. 148.

FAS 123R is effective as of the beginning of the first interim or annual reporting period that begins after June 15, 2005 (i.e., the beginning of

the Company’s fiscal year 2006).

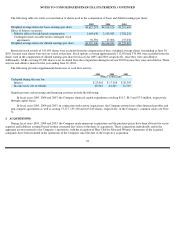

As previously discussed in conjunction with stock-based employee compensation plans, the Company currently has three types of stock-

based compensation: stock options, equity-based SARs and restricted stock. The Company adopted the fair value recognition provisions of

FAS No. 123 using the prospective transition method as of the beginning of fiscal year 2004. No SARS or restricted stock were issued before

fiscal year 2004; therefore, the adoption of FAS No. 123R will have no effect with respect to these types of stock-based awards. However, in

compliance with the prospective transition method under FAS No. 148, no compensation expense is currently recognized in the Company’s

Consolidated Statement of Operations with respect to stock options granted prior to fiscal year 2004 (the date upon which the Company

adopted the fair value recognition provisions under FAS No. 123). The Company will adopt FAS No. 123R July 1, 2005. Under the provisions

of FAS 123R, compensation expense will also be recognized in earnings over the vesting period for stock options which remain unvested as of

the date of adoption (July 1, 2005), regardless of their grant date. Additionally, in March 2005, the SEC issued Staff Accounting Bulletin

No. 107 (SAB 107) to assist preparers by simplifying some of the implementation challenges of FAS 123R while enhancing the information

investors receive. The Company plans to follow the modified prospective transition provision under FAS 123R, as clarified by SAB 107, and

expects the adoption of FAS 123R to incrementally increase compensation expense by approximately $2.6 million during fiscal year 2006.

In November, 2004, the FASB issued FAS No. 151, “Inventory Costs, an Amendment of ARB No. 43, Chapter 4” (FAS No. 151). FAS

No. 151 clarifies the accounting for abnormal amounts of idle facility expense, freight, handling costs and wasted material (spoilage) by

requiring all such costs to be recognized as current period charges regardless of whether or not the costs meet the criterion of “so abnormal.”

Additionally, the Statement requires that the allocation of fixed production overheads to the costs of conversion be based on the normal

capacity of the production facilities. This Statement is effective prospectively for inventory costs incurred during fiscal years beginning after

June 15, 2005 (i.e., the Company’s fiscal year 2006). The Company is currently evaluating the impact of adopting this Statement on its

Consolidated Financial Statements.

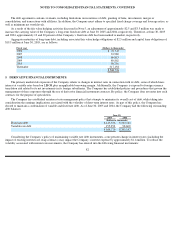

In October, 2004, the FASB ratified the consensus reached by the Emerging Issues Task Force (EITF) on EITF Issue No. 04-1

“Accounting for Preexisting Relationships between the Parties to a Business Combination” (EITF 04-1). This EITF requires, upon the

acquisition of a business, acquiring companies to separately account for any pre-existing contractual relationships with the acquired entity.

Amounts paid in settlement of any executory contracts must be expensed, measured at the lesser of (a) the amount by which the contract is

favorable or unfavorable to market (from the acquiring company’s perspective) or (b) any stated settlement provisions in the contract. The

reacquisition of an acquired entity’s contractual right to use the acquiring company’

s intangible assets must be recognized as an intangible asset

apart from goodwill, measured at a value not to exceed any stated reacquisition amount included in the contract. If a business combination

effectively settles a lawsuit or executory contract and that settlement results in a gain or loss for the acquiring company, that company must

recognize a settlement gain or loss. The following disclosures are also required by EITF 04-1: (a) the nature of the pre-existing relationship;

(b) the fair value of the acquired entity’s assets and liabilities that were settled,

72