SkyWest Airlines 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

direct costs associated with operating Delta Connection flights, plus a payment based on block hours flown. In addition, the SkyWest

Airlines Delta Connection Agreement provides for us to increase our profitability if we reduce our total costs. SkyWest Airlines’

United operations are conducted under a United Express Agreement pursuant to which SkyWest Airlines is paid primarily on a fee-

per-completed block hour and departure basis plus a margin based on performance incentives. Under the United Express Agreement,

excess margins over certain percentages must be returned or shared with United, depending on various conditions.

ASA

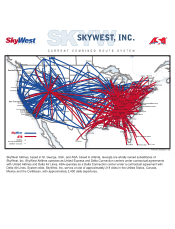

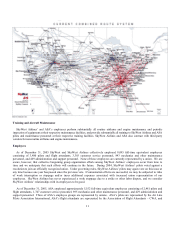

ASA largely provides regional jet service in the United States east of the Mississippi River, with the exception of flying provided

to Delta out of its Salt Lake City hub. ASA offered more than 850 daily scheduled departures as of December 31, 2005, all of which

were Delta Connection flights. ASA’s operations are conducted primarily from hubs located in Atlanta, Salt Lake City and

Cincinnati. ASA’s fleet as of December, 2005, all of which were flown for Delta, consisted of 35 70-seat CRJ700s, 106 40 and 50-

seat CRJ200s, and twelve ATR-72 turboprops (which we expect to remove from service by August 2007). Under the terms of the

ASA Delta Connection Agreement, Delta has agreed to compensate ASA for its direct costs associated with operating Delta

Connection flights, plus, if ASA completes a certain minimum percentage of its Delta Connection flights, a specified margin on such

costs. Additionally, the ASA Delta Connection Agreement provides for incentive compensation upon satisfaction of certain

performance goals. Under the ASA Delta Connection Agreement, excess margins over certain percentages must be returned or

shared with Delta, depending on various conditions.

Growth Opportunities

During the five years ended December 31, 2005, our total operating revenues expanded at a compounded annual rate of 20.4%

and the number of daily flights we operated increased from approximately 950 at the end of 2000 to approximately 2,400 as of

December 31, 2005. With the exception of our acquisition of ASA, our growth during that five-year period was internally generated.

We believe there are additional opportunities for expansion of our operations, consisting primarily of:

• Delivery of Aircraft Under Firm Order. We have firm orders to acquire 15 additional CRJ700s and 17 CRJ900s during

the two-year period ending December 31, 2007. We have also obtained the right to sublease from Delta six additional

CRJ200s. We have agreements with Delta or United to place all 38 of these aircraft into revenue service, under long-term,

fixed-fee contracts, promptly following their delivery.

• Potential Opportunities from Delta’s Restructuring. We believe that as Delta restructures its fleet under bankruptcy

protection, there may be new regional flying contracts that become available for qualified regional carriers. ASA holds

certain rights to maintain its proportion of overall Delta regional flights, as well as its proportion of Atlanta regional flights.

This may help ASA compete for new flying mandates, if any, that come into existence at Delta.

• Scope Clause Relief. “Scope clauses” are elements of major airlines’ labor contracts with their own pilots that place

restrictions on the number and size of aircraft, or the amount of flight activity, that can be operated by major airlines’

regional airline contractors such as ASA and SkyWest Airlines. Greater liberalization of scope clauses generally creates

more business opportunities for regional airlines. Since 2001, five of the six major national airlines (American Airlines, Inc.

(“American”), Delta, Northwest Airlines, Inc. (“Northwest”), United and US Airways) have successfully achieved some

scope clause liberalization. If further efforts by major airlines to relax scope clause restrictions are successful, it may create

incremental opportunities for regional airlines.

• Narrowbody Replacement Flying. A meaningful portion of the recent growth of the regional airline industry resulted

from the replacement of major airline-operated narrowbody jet aircraft (such as 737s, DC9s, MD80s and A319s) with

regional airline-operated jets on the same route. The major airline affects this change in equipment to achieve an advantage

in trip costs, unit costs, frequency or a combination of these benefits. At present, the six major national airlines have a

significant number of narrowbody aircraft that are more than 15 years old in their fleets. Such older aircraft are frequently

less fuel- and maintenance-efficient than new aircraft. If major airlines decide to substitute newer regional airline-operated

equipment for any portion of these older narrowbody aircraft under their retirement, it may create incremental opportunities

for regional airlines.