SkyWest Airlines 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

Horizon, are wholly-owned subsidiaries of major airlines. In contrast to low cost carriers, regional airlines generally do not try to

establish an independent route system to compete with the major airlines. Rather, regional airlines typically enter into relationships

with one or more major airlines, pursuant to which the regional airline agrees to use its smaller, lower-cost aircraft to carry

passengers booked and ticketed by the major airline between a hub of the major airline and a smaller outlying city. In exchange for

such services, the major airline pays the regional airline either a fixed flight fee, termed “contract” or “fixed-fee” flights, or receives a

percentage of applicable ticket revenues, termed “pro-rate” or “revenue-sharing” flights.

Growth of the Regional Airline Industry

According to the Regional Airline Association, the regional airline sector of the airline industry experienced compounded annual

passenger growth of 12.3% between 2000 and 2004. We believe the growth of the number of passengers using regional airlines and

the revenues of regional airlines during the last decade is attributable to a number of factors, including:

• Regional airlines work with, and often benefit from the strength of, the major airlines. Since many major airlines have

incorporated increased use of regional airlines into their future growth strategies, many regional airlines have expanded,

and may continue to expand, with the major airlines they serve.

• Regional airlines tend to have a more favorable cost structure and leaner corporate structure than many major airlines.

Many regional airlines were founded in the midst of the highly competitive market that developed following

deregulation of the airline industry in 1978.

• Many major airlines have determined that an effective method for retaining customer loyalty and maximizing system

revenue, while lowering costs, is to outsource shorter, low-volume routes to more cost-efficient regional airlines flying

under the major airline’s code and name.

• Regional airlines are gradually replacing smaller turboprop planes with 32 to 110-seat regional jets. Such regional jets

feature cabin class comfort, low noise levels and speed similar to the 120-seat plus aircraft operated by the major

airlines, but are cheaper to acquire and operate because of their smaller size. We believe the increasing use of regional

jets has led, and may continue to lead, to greater public acceptance of regional airlines.

Relationship of Regional and Major Airlines

Regional airlines generally enter into code-share agreements with major airlines, pursuant to which the regional airline is

authorized to use the major airline’s two-letter flight designator codes to identify the regional airline’s flights and fares in the central

reservation systems, to paint its aircraft with the colors and/or logos of its code-share partner and to market and advertise its status as

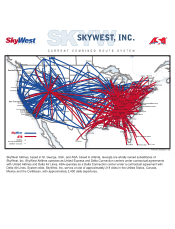

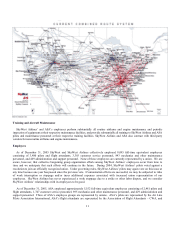

a carrier for the code-share partner. For example, SkyWest Airlines flies out of Chicago (O’Hare), Denver, Los Angeles, San

Francisco, Portland and Seattle/Tacoma as United Express and out of Salt Lake City as The Delta Connection. ASA operates as The

Delta Connection out of Atlanta, Cincinnati and Salt Lake City. In addition, the major airline generally provides services such as

reservations, ticketing, ground support and gate access to the regional airline, and both partners often coordinate marketing,

advertising and other promotional efforts. In exchange, the regional airline provides a designated number of low-capacity (usually

between 30 and 70 seats) flights between larger airports served by the major airline and surrounding cities, usually in lower-volume

markets.

The financial arrangements between the regional airlines and their code-share partners usually involve contract, or fixed-fee,

payments based on the flights or a revenue-sharing arrangement based on the flight ticket revenues, as explained below:

• Fixed-Fee Arrangements. Under a fixed-fee arrangement, the major airline generally pays the regional airline a fixed-

fee based on the flight, with additional incentives based on completion of flights, on-time performance and baggage handling

performance. In addition, the major and regional airline often enter into an arrangement pursuant to which the major airline bears the

risk of changes in the price of fuel and other such costs that are passed through to the major airline partner. Regional airlines benefit

from a fixed-fee arrangement because they are sheltered from most of the elements that cause volatility in airline earnings, including

variations in ticket prices, passenger loads and fuel prices. However, regional airlines in fixed-fee arrangements do not benefit from

positive trends in ticket prices, passenger loads or fuel prices and, because the major airlines absorb most of the risks, the margin