SkyWest Airlines 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

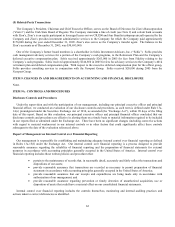

(8) Related-Party Transactions

The Company’s President, Chairman and Chief Executive Officer, serves on the Board of Directors for Zion’s Bancorporation

(“Zion’s”) and the Utah State Board of Regents. The Company maintains a line of credit (see Note 2) and certain bank accounts

with Zion’s, Zion’s is an equity participant in leveraged leases on two CRJ200 and four Brasilia turboprop aircraft operated by the

Company and Zion’s provides investment administrative services to the Company for which the Company paid approximately

$176,000 during the year ended December 31, 2005. Zion’s also serves as the Company’s transfer agent. The balance in the

Zion’s accounts as of December 31, 2005, was $30,693,000.

One of the Company’s former board members is a shareholder in Soltis Investment Advisors, Inc. (“Soltis”). Soltis provides

cash management advisory services for a portion of the Company’s cash programs, to the Retirement Plan and the Company’s

deferred executive compensation plan. Soltis received approximately $263,000 in 2005 for fees from Fidelity relating to the

Company’s cash programs. Soltis received approximately $144,850 in 2005 for fees for advisory services to the Company’s 401k

retirement plan and deferred compensation plan. With respect to the executive deferred compensation plan for the officer group,

Soltis provides consulting services in conjunction with the Newport Group. Soltis received $20,000 during 2005 from the

Newport Group.

ITEM 9. CHANGES IN AND DISAGREEMENTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our principal executive officer and principal

financial officer, we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Rule 13a-

14(c) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), within 90 days of the filing

date of this report. Based on this evaluation, our principal executive officer and principal financial officer concluded that our

disclosure controls and procedures are effective in alerting them on a timely basis to material information required to be included

in our reports filed or submitted under the Exchange Act. There have been no significant changes (including corrective actions

with regard to material weaknesses) in our internal controls or in other factors that could significantly affect these controls

subsequent to the date of the evaluation referenced above.

Report of Management on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined

in Rules 13a-15(f) under the Exchange Act. Our internal control over financial reporting is a process designed to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with accounting principles generally accepted in the United States of America. Internal control over

financial reporting includes those written policies and procedures that:

• pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and

dispositions of our assets;

• provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial

statements in accordance with accounting principles generally accepted in the United States of America;

• provide reasonable assurance that our receipts and expenditures are being made only in accordance with

authorization of our management; and

• provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or

disposition of assets that could have a material effect on our consolidated financial statements.

Internal control over financial reporting includes the controls themselves, monitoring and internal auditing practices and

actions taken to correct deficiencies as identified.