SkyWest Airlines 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Of the shares sold in excess of the Employee Stock Purchase Plan’s authorized limit, 154,126 shares were sold on January 4,

2005 at a price of $14.35 per share and 175,480 shares were sold on July 5, 2005 at a price of $15.45 per share. Pursuant to the

provisions of the Employee Stock Purchase Plan, the amounts paid by the participating employees for the shares were withheld as

payroll deductions from compensation we would have otherwise paid to such employees during the six-month period preceding

the month of each sale.

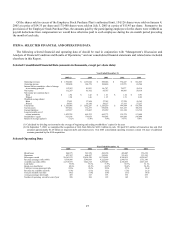

ITEM 6. SELECTED FINANCIAL AND OPERATING DATA

The following selected financial and operating data of should be read in conjunction with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and related notes included

elsewhere in this Report.

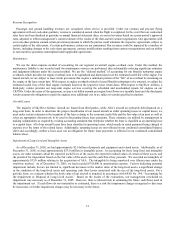

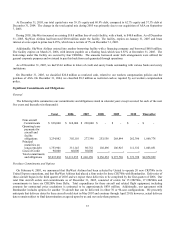

Selected Consolidated Financial Data (amounts in thousands, except per share data):

Year Ended December 31,

2005(2) 2004 2003 2002 2001

Operating revenues $ 1,964,048 $ 1,156,044 $ 888,026 $ 774,447 $ 601,865

Operating income 220,408 144,776 108,480 119,555 65,564

Income before cumulative effect of change

in accounting principle 112,267 81,952 66,787 78,277 50,516

Net income 112,267 81,952 66,787 86,866 50,516

Net income per common share:

Basic $ 1.94 $ 1.42 $ 1.16 $ 1.52 $ 0.90

Diluted 1.90 1.40 1.15 1.51 0.88

Weighted average shares:

Basic 57,851 57,858 57,745 57,229 56,365

Diluted 58,933 58,350 58,127 57,551 57,237

Total assets $ 3,320,646 $ 1,662,287 $ 1,529,210 $ 999,384 $ 831,566

Current assets 693,632 712,337 670,368 513,233 386,556

Current liabilities 615,917 170,467 151,959 121,388 115,738

Long-term debt, net of

current maturities 1,422,758 463,233 462,773 125,379 113,688

Stockholders’ equity 913,198 779,055 709,063 638,686 545,840

Return on average equity(1) 13.2% 11.0% 9.9% 14.7% 9.8%

(1) Calculated by dividing net income by the average of beginning and ending stockholders’ equity for the year

(2) On September 7, 2005, we completed the acquisition of ASA from Delta for $421.3 million in cash. We paid $5.3 million of transaction fees and ASA

assumed approximately $1.25 billion in long-term debt and related assets. Our 2005 consolidated operating revenues contain 114 days of additional

revenue generated by the ASA acquisition.

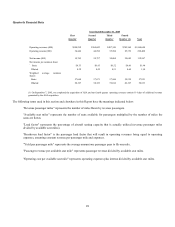

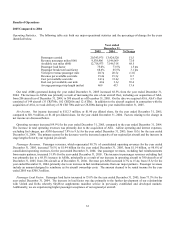

Selected Operating Data

Year Ended December 31,

2005 2004 2003 2002 2001

Block hours 866,975 589,129 482,158 405,007 356,370

Departures 623,307 464,697 395,631 351,631 333,383

Passengers carried 20,343,975 13,424,520 10,738,691 8,388,935 6,229,867

Revenue passenger miles (000) 9,538,906 5,546,069 4,222,669 2,990,753 1,732,180

Available seat miles (000) 12,718,973 7,546,318 5,875,029 4,356,053 2,837,278

Load factor 75.0% 73.5% 71.9% 68.7% 61.1%

Break-even load factor 68.6% 65.5% 63.9% 58.4% 54.4%

Yield per revenue passenger mile 20.3¢ 20.5¢ 20.9¢ 25.7¢ 34.4¢

Revenue per available seat mile 15.4¢ 15.3¢ 15.1¢ 17.8¢ 21.2¢

Cost per available seat mile 14.1¢ 13.6¢ 13.4¢ 15.1¢ 18.9¢

Average passenger trip length 469 413 393 356 278

Number of operating aircraft at end of year 380 206 185 149 131