SkyWest Airlines 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

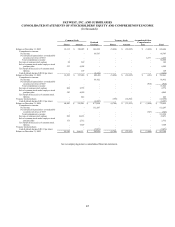

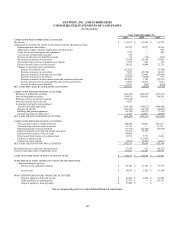

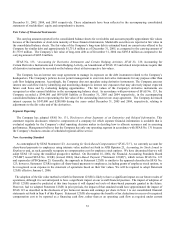

The calculation of the weighted average number of common shares outstanding for Basic EPS and Diluted EPS are as follows

for the years ended December 31, 2005, 2004 and 2003 (in thousands):

Year Ended December 31,

2005 2004 2003

Numerator:

Numerator for earnings per share $ 112,267 $ 81,952 $ 66,787

Denominator:

Denominator for basic earnings per-share

weighted average shares 57,851 57,858 57,745

Dilution due to stock options 1,082 492 382

Denominator for diluted earnings per-share

weighted average shares 58,933 58,350 58,127

Basic earnings per-share $ 1.94 $ 1.42 $ 1.16

Diluted earnings per -share $ 1.90 $ 1.40 $ 1.15

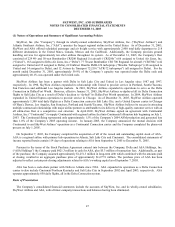

Stock Options

The Company applies Accounting Principles Board Opinion No. 25 and related interpretations in accounting for its stock-

based compensation plans. Statement of Financial Accounting Standards (“SFAS”) No. 123, Accounting for Stock-Based

Compensation, requires pro forma information regarding net income and net income per share as if the Company had accounted

for its stock options under the fair value method of the statement which is described more fully in Note 5 below. The Company

did not record any stock-based compensation expense related to stock options for the years ended December 31, 2005, 2004 and

2003.

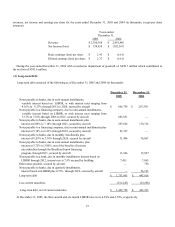

The following table contains the pro forma disclosures and the related impact on net income and net income per share (in

thousands, except per share information):

Year Ended December 31,

2005 2004 2003

Net income:

As reported $ 112,267 $ 81,952 $ 66,787

Stock based compensation under

fair value method (4,927) (6,706

)

(7,679)

Pro forma $ 107,340 $ 75,246 $ 59,108

Net income per common share:

Basic as reported $ 1.94 $ 1.42 $ 1.16

Basic pro forma $ 1.86 $ 1.30 $ 1.02

Diluted as reported $ 1.90 $ 1.40 $ 1.15

Diluted pro forma $ 1.82 $ 1.29 $ 1.02

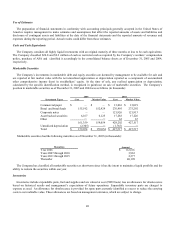

Comprehensive Income

The Company reports comprehensive income in accordance with SFAS No. 130, Reporting Comprehensive Income, which

establishes standards for reporting and displaying comprehensive income and its components in financial statements.

Comprehensive income includes charges and credits to stockholders’ equity that are not the result of transactions with

shareholders. As of December 31, 2005 and 2004, accumulated other comprehensive loss includes adjustments, net of tax, to

reflect unrealized appreciation (depreciation) on marketable securities. The Company recorded net unrealized appreciation

(depreciation) of $(347,000), $(910,000), and $1,273,000, net of income taxes, on marketable securities for the years ended