SkyWest Airlines 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

Interruptions or disruptions in service at one of our hub airports, due to adverse weather or for any other reason, could

have a material adverse impact on our operations.

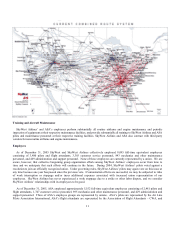

We currently operate primarily through hubs in Atlanta, Los Angeles, San Francisco, Salt Lake City, Chicago, Denver,

Cincinnati/Northern Kentucky and the Pacific Northwest. Nearly all of our flights will either originate or fly into one of these

hubs. Our revenues depend primarily on our completion of flights and secondarily on service factors such as timeliness of

departure and arrival. Any interruptions or disruptions could, therefore, severely and adversely affect us. Extreme weather can

cause flight disruptions, and during periods of storms or adverse weather, fog, low temperatures, etc., our flights may be canceled

or significantly delayed. Hurricanes Katrina and Rita, in particular, caused severe disruption to air travel in the affected areas and

adversely affected airlines operating in the region, including ASA. We operate a significant number of flights to and from

airports with particular weather difficulties, including Atlanta, Salt Lake City, Chicago and Denver. A significant interruption or

disruption in service at one of our hubs, due to adverse weather or otherwise, could result in the cancellation or delay of a

significant portion of our flights and, as a result, could have a severe impact on our business, operations and financial

performance.

Fluctuations in interest rates could adversely affect our liquidity, operating expenses and results.

A substantial portion of our indebtedness bears interest at fluctuating interest rates. These are primarily based on the London

interbank offered rate for deposits of U.S. dollars, or LIBOR. LIBOR tends to fluctuate based on general economic conditions,

general interest rates, federal reserve rates and the supply of and demand for credit in the London interbank market. We have not

hedged our interest rate exposure and, accordingly, our interest expense for any particular period may fluctuate based on LIBOR

and other variable interest rates. To the extent these interest rates increase, our interest expense will increase, in which event, we

may have difficulty making interest payments and funding our other fixed costs and our available cash flow for general corporate

requirements may be adversely affected.

Our business could be harmed if we lose the services of our key personnel.

Our business depends upon the efforts of our chief executive officer, Jerry C. Atkin, and our other key management and

operating personnel. We may have difficulty replacing management or other key personnel who leave and, therefore, the loss of

the services of any of these individuals could harm our business. We do not maintain key-man insurance on any of our

executives.

The Securities and Exchange Commission staff is investigating our accounting treatment of certain maintenance costs.

Effective January 1, 2002, we changed our method of accounting for certain engine overhaul expenses. In connection with

this change, we restated our financial statements for the year ended December 31, 2001 and the first and second quarters of the

year ended December 31, 2002. The staff of the SEC has been investigating the facts pertaining to this change in accounting

method and the related restatements. We have cooperated with this investigation, and have offered to enter into a cease and desist

order pursuant to which we would agree not to violate federal securities laws in the future. The SEC is currently reviewing our

offer. If our offer is not accepted, we may be required to devote additional time and resources in responding to the investigation,

and we could experience other adverse consequences.

Risks Related to the Airline Industry

We may be materially affected by the uncertainty of the airline industry.

The airline industry has experienced tremendous challenges in recent years and will likely remain volatile for the foreseeable

future. Among other factors, the financial challenges faced by major carriers, including Delta, United and Northwest, the slowing

U.S. economy and increased hostilities in Iraq, the Middle East and other regions have significantly affected, and are likely to

continue to affect, the U.S. airline industry. These events have resulted in declines and shifts in passenger demand, increased

insurance costs, increased government regulations and tightened credit markets, all of which have affected, and will continue to

affect, the operations and financial condition of participants in the industry, including us, major carriers (including our major

partners), competitors and aircraft manufacturers. These industry developments raise substantial risks and uncertainties which

will affect us, major carriers (including our major partners), competitors and aircraft manufacturers in ways that we are unable to

currently predict.