SkyWest Airlines 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

(5) Commitments and Contingencies

Lease Obligations

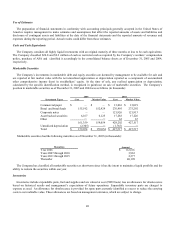

The Company leases 247 aircraft, as well as airport facilities, office space, and various other property and equipment under

non-cancelable operating leases which are generally on a long-term net rent basis where the Company pays taxes, maintenance,

insurance and certain other operating expenses applicable to the leased property. Management expects that, in the normal course

of business, leases that expire will be renewed or replaced by other leases. The following table summarizes future minimum

rental payments required under operating leases that have initial or remaining non-cancelable lease terms in excess of one year as

of December 31, 2005 (in thousands):

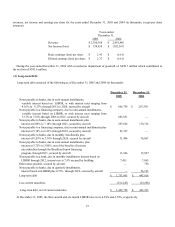

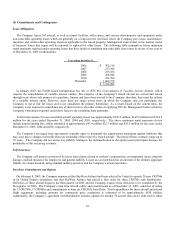

Year ending December 31,

2006 $ 302,110

2007 277,398

2008 253,556

2009 268,844

2010 262,396

Thereafter 1,869,778

$ 3,234,082

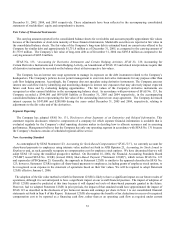

In January 2003, the FASB issued Interpretation No. 46, or (FIN 46), Consolidation of Variable Interest Entities, which

requires the consolidation of variable interest entities. The majority of the Company’s leased aircraft are owned and leased

through trusts whose sole purpose is to purchase, finance and lease these aircraft to the Company; therefore, they meet the criteria

of a variable interest entity. However, since these are single owner trusts in which the Company does not participate, the

Company is not at risk for losses and is not considered the primary beneficiary. As a result, based on the current rules, the

Company is not required to consolidate any of these trusts or any other entities in applying FIN 46. Management believes that the

Company’s maximum exposure under these leases is the remaining lease payments.

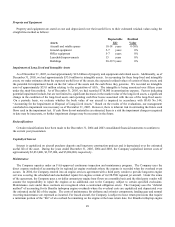

Total rental expense for non-cancelable aircraft operating leases was approximately $210.2 million, $145.9 million and $124.9

million for the years ended December 31, 2005, 2004 and 2003, respectively. The above minimum rental payments do not

include airport landing fees, which amounted to approximately $47.9 million $32.7 million and $26.5 million for the years ended

December 31, 2005, 2004 and 2003, respectively.

The Company’s leveraged lease agreements, typically agree to indemnify the equity/owner participant against liabilities that

may arise due to changes in benefits from tax ownership of the respective leased aircraft. The terms of these contracts range up to

18 years. The Company did not accrue any liability relating to the indemnification to the equity/owner participant because the

probability of this occurring is remote.

Self-insurance

The Company self-insures a portion of its losses from claims related to workers' compensation, environmental issues, property

damage, medical insurance for employees and general liability. Losses are accrued based on an estimate of the ultimate aggregate

liability for claims incurred, using standard industry practices and the Company’s actual experience.

Purchase Commitments and Options

On February 4, 2005, the Company announced that SkyWest Airlines had been selected by United to operate 20 new CRJ700s

in its United Express operations, and that SkyWest Airlines had placed a firm order for these CRJ700s with Bombardier.

Deliveries of these aircraft began in the third quarter of 2005 and the Company expects these deliveries to be completed by the

first quarter of 2006. The Company’s total firm aircraft orders and commitments as of December 31, 2005, consisted of orders

for 15 CRJ700s, 17 CRJ900s and commitments to lease six CRJ200's from Delta. Total expenditures for these aircraft and related

flight equipment, including amounts for contractual price escalations is estimated to be approximately $838 million.

Additionally, the Company’s agreement with Bombardier includes options for another 70 aircraft that can be delivered in either